How to reply Non Compliance Income Tax notice ? – Income Tax department has started sending the notices under various section to individual Tax payers. There are many of the notices which are needed to be replied within stipulated time frame.

Before replying the Income Tax IT notices, one must know the reason for receiving the IT notices from Income Tax Department. Follow the below instruction to know the reason for receiving the Income Tax Notice.

Read : How To e-Verify Returns Using Bank or Demat Account ?

Steps to follow :

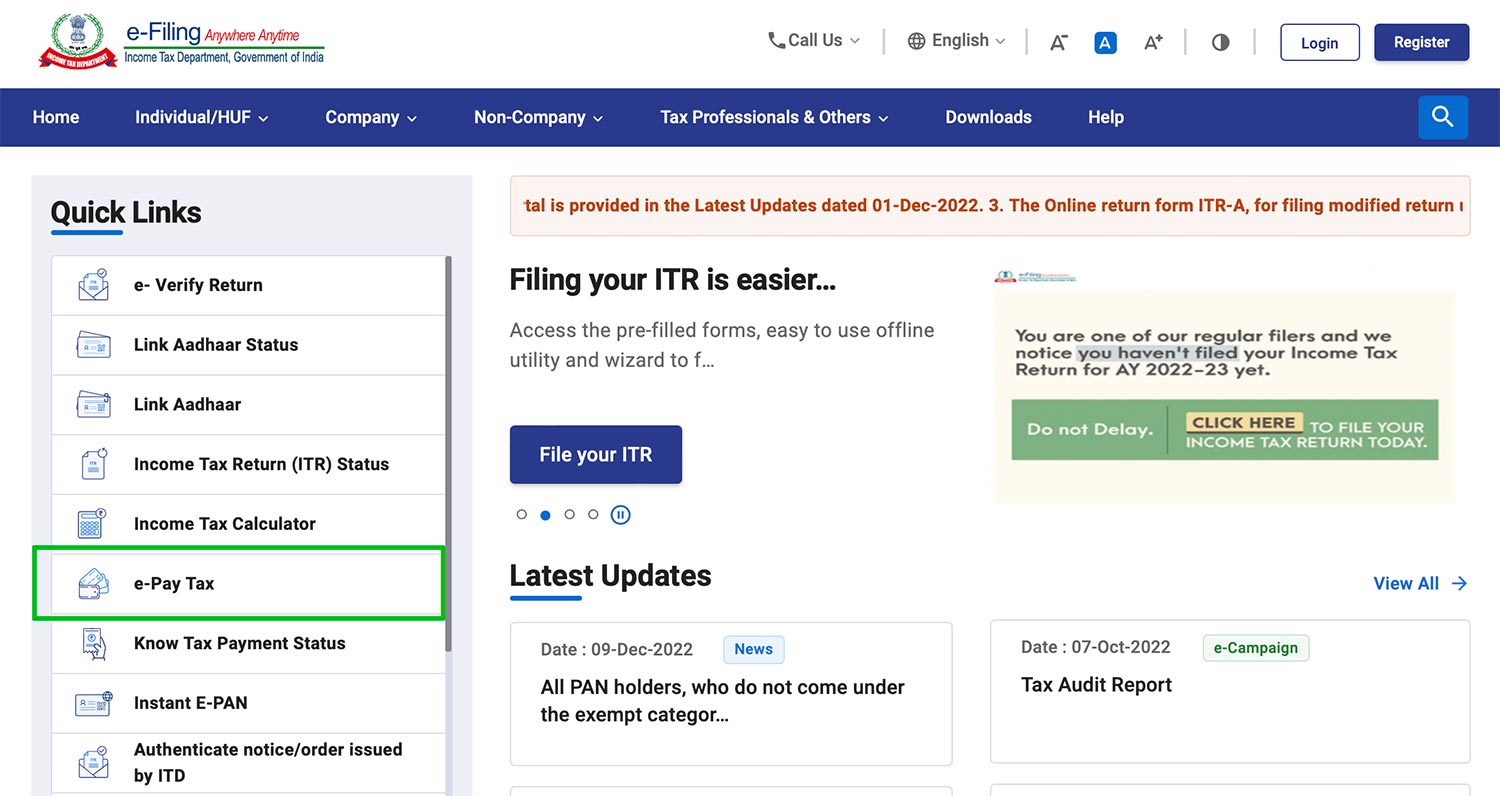

- Login to https://incometaxindiaefiling.gov.in

- Provide your User ID and Password

- After login Go To Dashboard

- Find Tab Compliance

- Check the reason for receiving the IT Notice

If User ID and Password not available, First register with your PAN and other details to generate the User ID and password.

Read : How To File Income Tax e-Filing Returns Online in Simple Steps ?

How To Reply the Compliance on IT Notice ?

Taxpayers are needed to reply the compliance under online mode following the below instruction :

Step 1: Login https://incometaxindiaefilling.gov.in

Step 2 : Click on “Compliance Tab”.

Step 3: View Non-filers information under Compliance tab.

Step 4: Submit Your Response

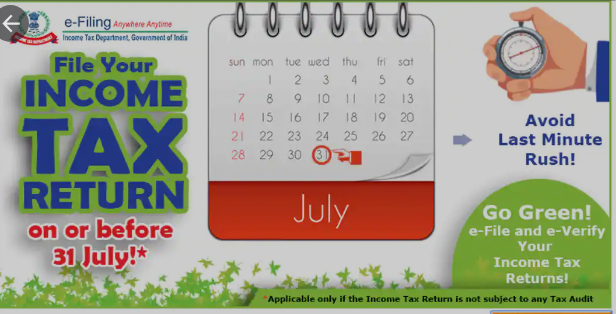

Income Tax department has also provided the process to submit response of non-filing of IT return. As per the Income tax Act Last date for filing returns for an individual is usually 31st July of the assessment year.

As per the provision Tax payers needed to file the income tax return before the deadline. If due to any reason, the taxpayer is not able to file his income tax return, he needs to submit the reason online before the end of the assessment year.

Steps to submit response of non-filing of IT return

Step 1: Login https://incometaxindiaefilling.gov.in

Step 2 : Click on “Compliance Tab”.

Step 3: View and submit compliance

Step 4: Choose the option i. ITR has been filed : ii. ITR has not been filed

Step 5 : Choose and provide the detail information as per your reason correctly

Step 6 : Submit the response

How to Know the reason for Receiving the IT Notice ?

In order to know the reason for receiving the notice individual needed to sign to https://incometaxindiaefilling.gov.in and choose the option Related Information Summary. Under this section check the Financial Year, and information under sub code. Each of the code given are related to certain report .

Click To Download Income Tax Calculator FY 2015-16 For Bankers

For example

- CIB-404 is for Deposit exceeding Rs. 2,00,000 in any account with Post Office.

- 94A – Interest other than interest on securities (Section 194A) or in general the Fixed deposit income

- AIR-002 : Paying Credit card bill of Rs. 2,00,000 or more