Recently Income tax department has made many modifications in the existing ITR forms. There are different types of income tax return (ITR) forms—ITR-1 to ITR-7—for filing of returns by different income tax assesses. Need of forms depend on the amount of income, source of income, ownership of assets and many other things.

Anyone can download the requisite ITR forms from income tax website.

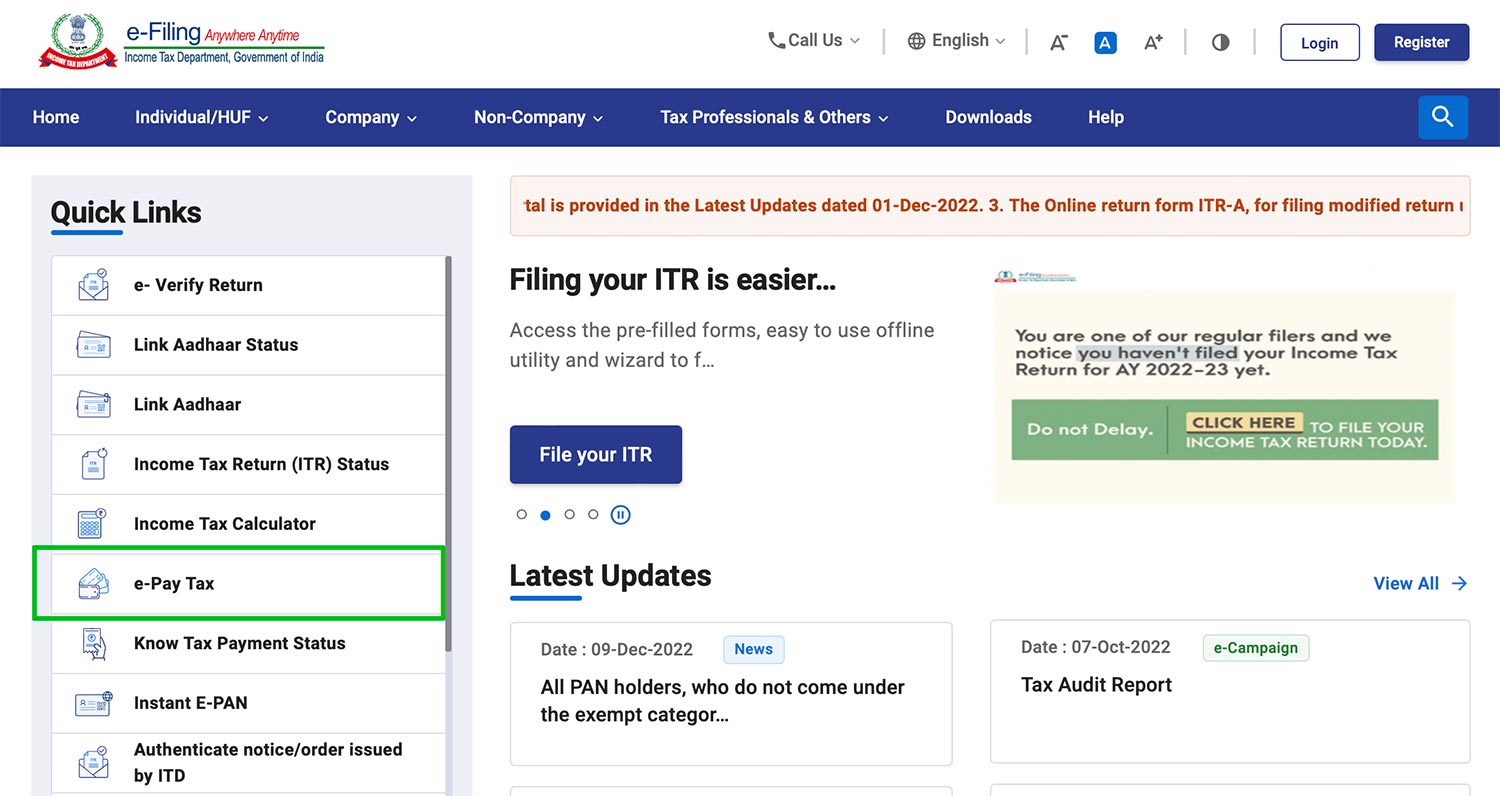

How To File Income Tax e-Filing Returns Online in Simple Steps ?

Key Highlights :

Who can fill ITR-1?

An individual income tax assessee, whose primary source of income is salary or pension can use ITR-1 to file their returns.

Click To Download Income Tax Calculator in Excel for AY 2018-19

Same ITR-1 can also be used in case of other income which includes income from one house property (provided there is no brought forward loss or loss to be carried forward) and income from other sources (other than income from lottery, race horses, or unexplained income and so on). However, total income combining all the mentioned sources should not exceed Rs50 lakh, else ITR-1 cannot be used.

This case is mandatory if the income is clubbed of another person—spouse or minor child—with their own income.

Who can’t Fill ITR-1?

File Your Revised Income Tax Returns By 31st March or Be Prepared to Face Penalty or Prosecution.

- Non resident

- Individuals who have dividend income exceeding Rs10 lakh, or have income from capital gains should also use other ITR forms as applicable.

- Having agriculture income exceeding Rs5,000 or having income from business or profession.

- Also, if a resident individual has any income from any source outside India or have any assets (including financial interest in an entity) located outside India should not use ITR-1 to file her return.

Income Tax Department has made it clear that choosing wrong ITR form, while filing income tax return, the department may consider it invalid, so take care while choosing a form.