Salary Arrears Income tax Relief Calculator FY 2015-16 – After the settlement of 10th Bipartite Settlement the salaried arrears have been paid to the Individual employees with deduction of Income Tax on arrears paid. Due to payment of Arrears at once for the previous financial years the Income tax liabilities have been increased with change of slab rate.

Since the arrears have been paid for the previous year salary the taxation part should also be calculated accordingly for each financial year. The bi bifurcation of arrears paid is needed as per the respective financial year in order to get relief of Income tax.

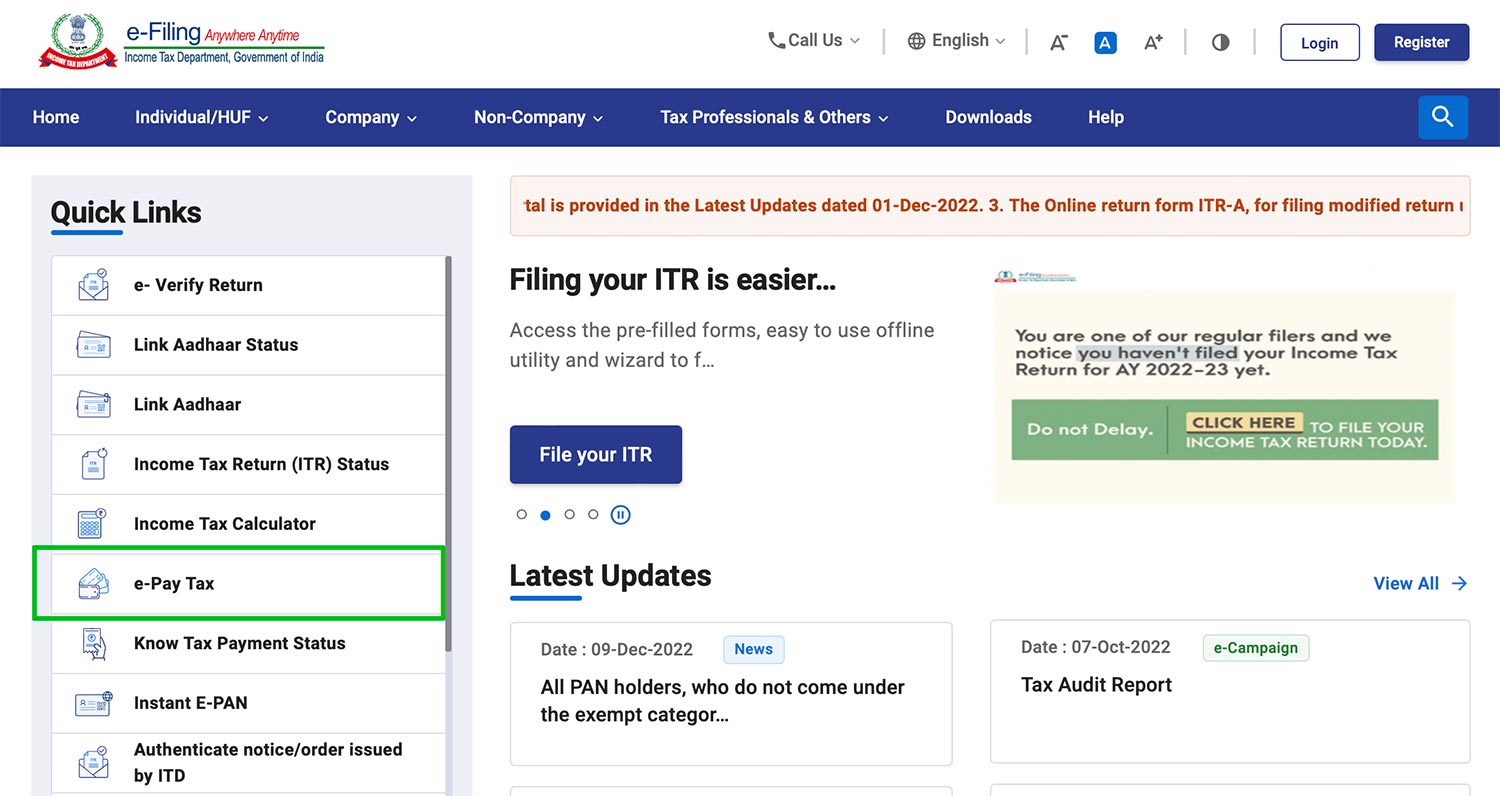

There is a provision in Income tax to get the relief on arrears paid under section 89 (1), rule 21A where the bifurcation of arrears can be made as per the respected financial years and after filling the form 10 (e).

Example : take an example : suppose any scale IV employee of bank earn Rs.11 lakhs per annum in FY 2014, and receive arrears of rs four lacs of FY 2013. The actual salary without arrears in FY 2013 was Rs.9 lakh.

Now in FY14, without the arrears the tax liability for officer will be suppose Rs.1.50 lakh after required investment, but the Tax liability will increased to suppose rs 2.60 lacs once the arrears are paid.

The enhanced tax liability of Rs 1.10 lakhs which is being charged in Year 2014 should have been charged in FY 2013 where as the Tax liability paid in the year 2013 was approx rs 90,000 without arrears. Where as with the arrears he needs to pay the tax of Rs 2.05 lacs. Now As per the Income Tax Section 89 (1) Officer may claim the Tax relief of Rs 35,000 i.e. (Rs.1.50 lakh – Rs.1.15 lakh)

How To Use the Salary Arrears Income tax Relief Calculator FY 2015-16 ?

Download Income Tax Calculator For FY 2015-16 and AY 2016-17 Here

Follow the Instruction below to use the calculator and download free auto generated Form 10 (e)

- Download the Excel file here

- Enter your Arrears details month wise

- Enter your details

- Computed tax relief on the details provided will automatically calculated

- Take a Print of form 10 (e)

- Sign it and submit to your employer for tax relief

NOTE : This website nor the author take any responsibility of data filled by You. We suggest you to take the advise from the expert or Income Tax department after filling the details and before claiming tax benefit.