Know to Link PAN-Aadhaar For Income Tax Return – The last date to link Aadhaar with PAN card is 31 March 2021. Your PAN may be declared “inoperative” and useless if it is not linked with the Aadhaar by this date. If your PAN is not linked to your Aadhaar, then from 1 April you will not be able to do any financial transactions for which PAN is mandatory.

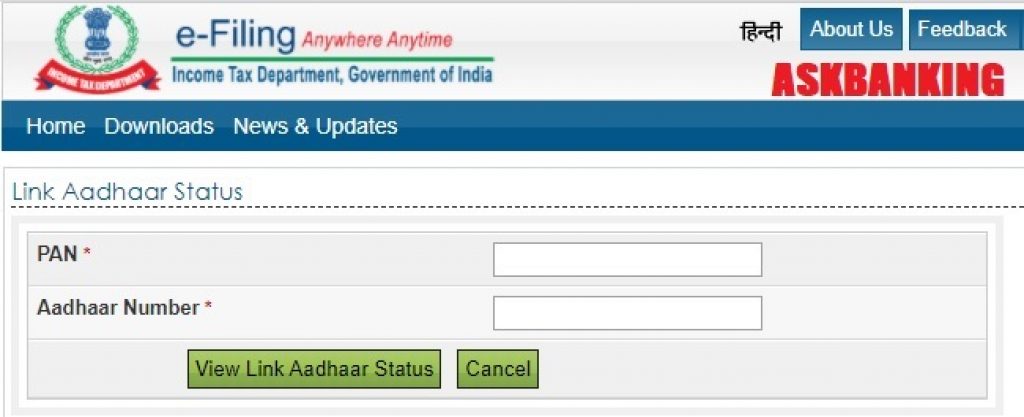

How to Know PAN- Aadhaar Link Status ?

Key Highlights :

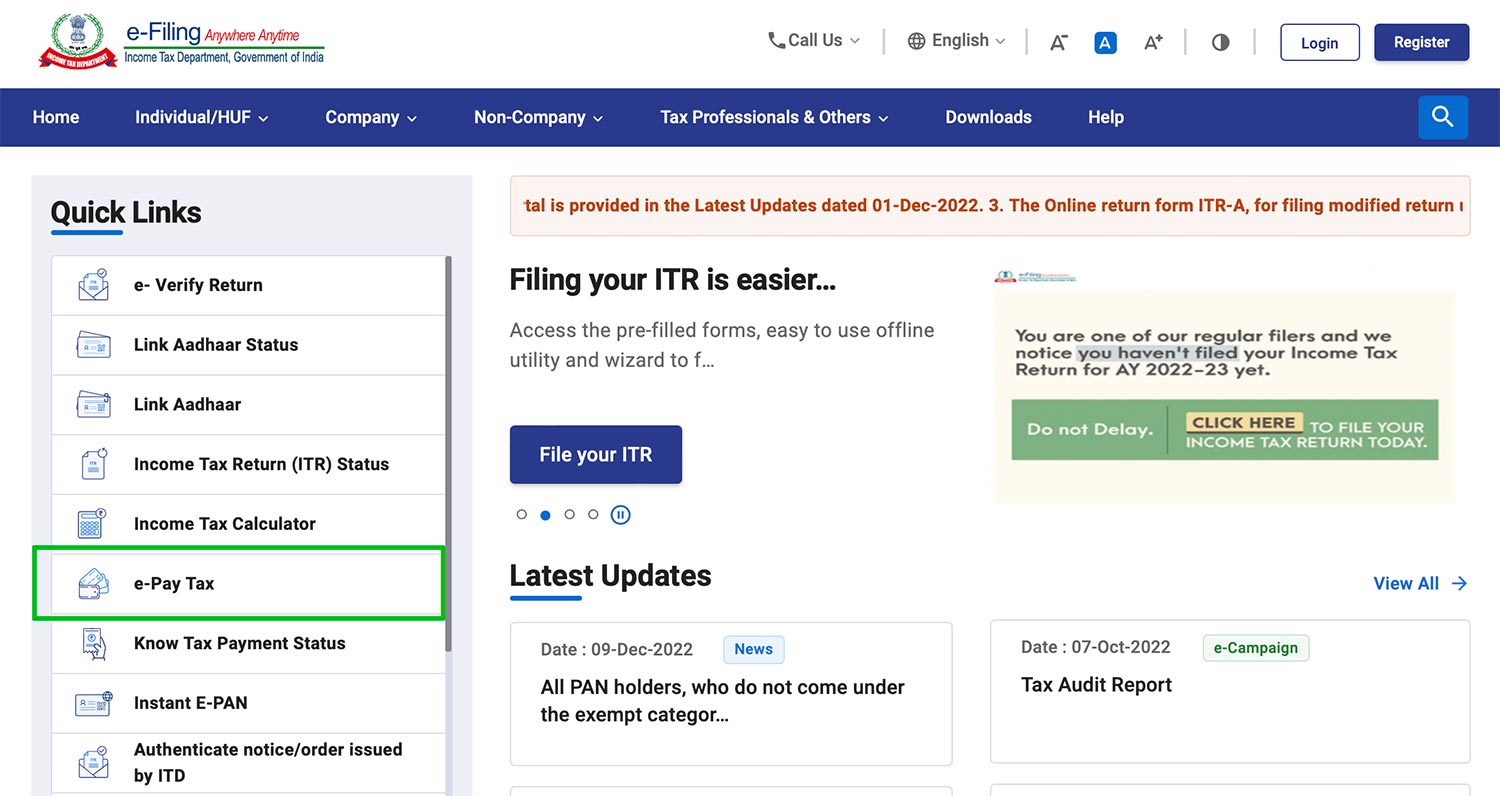

- Visit www.incometaxindiaefiling.gov.in/aadhaarstatus

- Enter PAN and Aadhaar Number

- Click on ‘View Link Aadhaar Status‘

- The status of the linking is displayed in the next screen

PAN Aadhaar Link Status through SMS

To check the status of PAN-Aadhaar linking through SMS, the user needs to send an SMS to 567678 or 56161 in the following format:

UIDPAN < 12 digit Aadhaar number> < 10 digit Permanent Account Number>

If the linking is successful, a message reading “Aadhaar…is already associated with PAN..in ITD database. Thank you for using our services.”

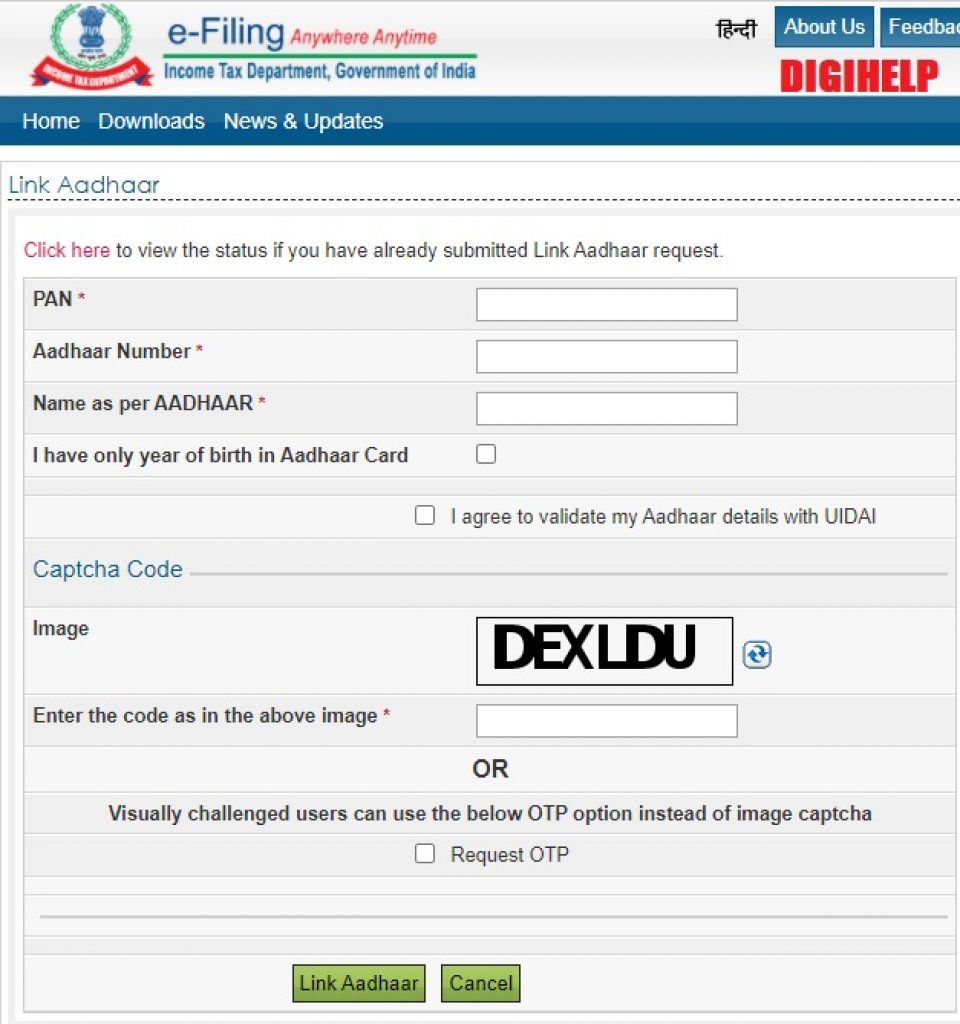

How To Link PAN With Aadhaar Online ?

- Visit the Income Tax India Website here

- Enter Your Details like PAN and Aadhaar

- An OTP will be sent for validation on registered mobile number

- Post validation, the message will be displayed that your PAN is linked with Aadhaar.

- Done !! Very Easy !!

Penalty of Not Linking PAN with Aadhaar:

In the Finance Bill, 2021, the government has introduced an amendment under which a person will be liable to pay a late fee of up to Rs 1,000 in case of non-linking of PAN with Aadhaar.

The Finance Bill (Lok Sabha) has introduced a new Section 234H to levy a fee for default in intimating the Aadhaar number. If a person is required to intimate his Aadhaar under Section 139AA(2) and such person fails to do so, they will be liable to pay a fee, as may be prescribed, not exceeding Rs 1,000 at the time of making such intimation.

Also Read – How to Get Tax Exemption for LTC, Leave Travel Concession ?

This means that if a person fails to link PAN and Aadhaar by 31 March, they will be liable to pay a fee of Rs 1,000. This fee shall be in addition to the other consequences the person has to face if PAN becomes inoperative due to non-maintenance of Aadhaar.