TDS Correction Statements are required to be filled by Deductor when Income Tax Online services i.e. Traces received more than one regular TDS/TCS statement for a particular TAN or Form within a particular Financial year and quarter.

If deductor needs to be filled any addition or updation in regular statement at the TIN Central System, the the same should be done by furnishing a correction statement.

[button color=”red” size=”small”]Why To File Correction Statements ?[/button]

All the payments details which are deposited in the form of Challan and mention in the regular TDS/TCS statement is verified with the corresponding details provided by the bank where tax was deposited.

On successful verification credit of tax deducted are reflected in the annual tax statement (Form 26AS) of the deductees If PAN of deductees are present.

26AS of the deductees will not show any payment If there are any deficiencies in the accepted regular TDS statement due to any reason like incorrect challan details or PAN not provided or provided incorrectly.

In order to provide the details about the Tax deducted in 26AS , Income Tax wanted to remove the deficiencies, if any, in the accepted regular TDS/TCS statement by filing a correction statement.

How to Update and File The Correction Statements ?

[box type=”info” ]1. C1 : Update deductor details such as Name, Address of Deductor.

2. C2 : Update challan details such as challan serial no., BSR code, challan tender date,challan amounts etc.

3.C3 : Update/delete /add deductee details.

4.C4 : Add / delete salary detail records.

5. C5 : Update PAN of the deductee or employee in deductee/salary details.

6. C6 : Add a new challan and underlying deductees

7. C7 : Cancel accepted statement. This is the extreme case where the TAN of the deductor itself is wrong.[/box]

It must be noted that single correction file may contain multiple correction statements. No need to file the separate correction statement for each of the error. A correction file containing more than one correction statement is called “multiple batch correction statement”.

How To Check inconsistencies in TDS return?

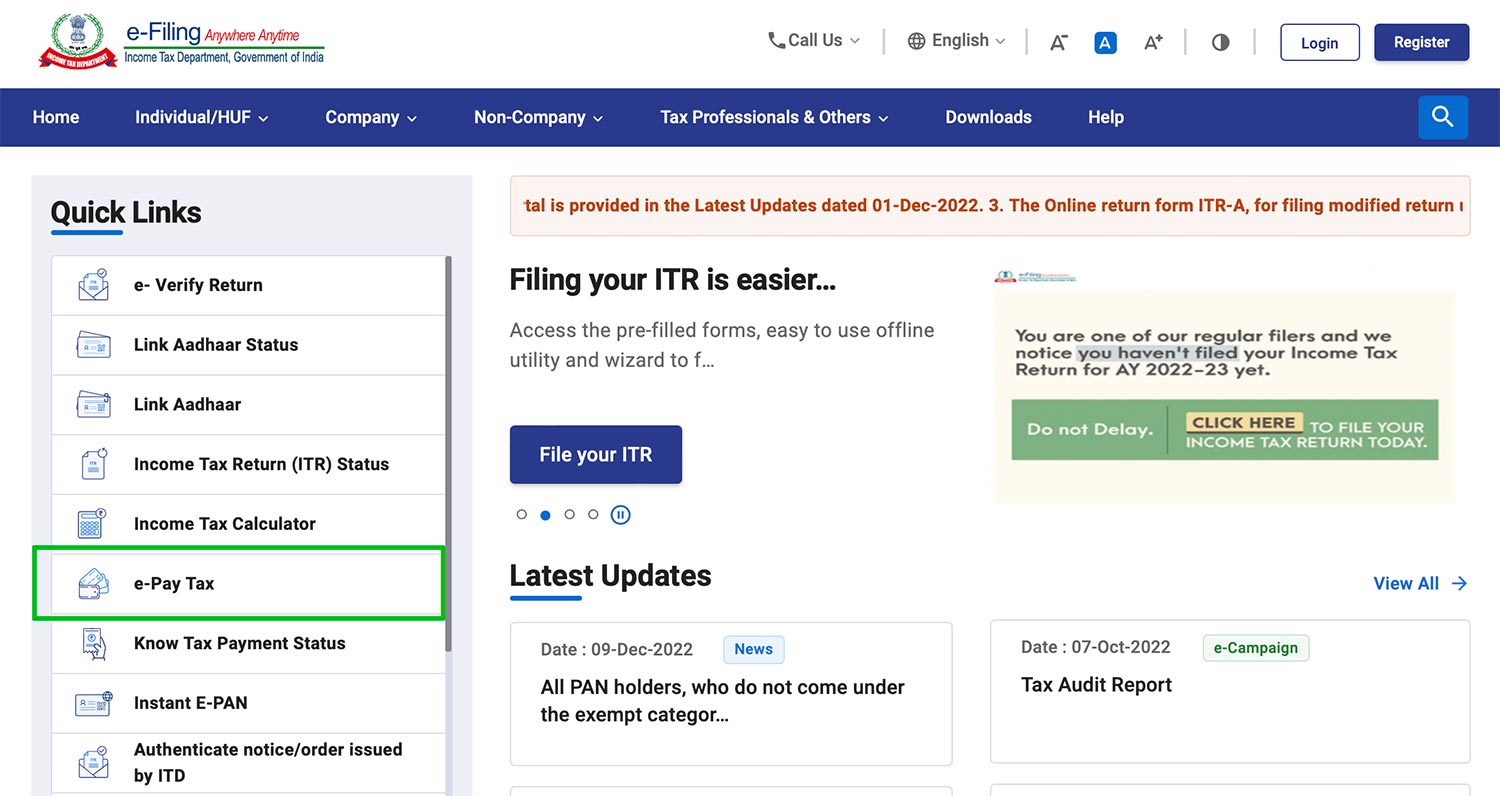

You can access TIN web-site ( www.tin-nsdl.com ). Click on the link “Quarterly Statement Status” and then provide your TAN and the Provisional Receipt Number (PRN) of the return.

| Challan Status | Error in Statement | Error in Challan details uploaded by the BANK / incorrect TAN provided by deductor in challan | Action to be taken by deductor for challan details |

| Challan fully Matched | No | No | No action |

| Match Failed (Amount does not match) | Yes | No | File correction statement |

| Match Failed (Amount does not match) | No | Yes | Contact Bank |

| Match Failed (Different TAN in challan and statement) | Yes | No | File correction statement |

| Match Failed (Different TAN in challan and statement) | No | Yes | Contact Assessing Officer |

| Match Failed (Amount + TAN mismatch) | Yes | No | File correction statement |

| Match Failed (Amount + TAN mismatch) | No | Yes | Contact Assessing Officer for TAN and Bank for Amount |

| Match Pending (CIN in statement not found in bank data) | Yes | No | File correction statement |

| Match Pending | No | Yes | Contact Assessing Officer |

* As per NSDL site

[button color=”red” size=”small” link=”https://tin.tin.nsdl.com/oltas/index.html” target=”blank” ]verify the details provided by the banks by using the “Challan Status Inquiry” facility [/button]

How To Prevent inconsistencies in Future TDS return?

As per the NSDL the suggestion which can prevent the duplicate work for filling the correction statements.

- Use the same TAN to deposit tax in the bank and to prepare the TDS statement.

- In case you have multiple TANs, only one TAN should be used consistently, the other TAN(s) should be surrendered to ITD.

- The deductor details, i.e. TAN, name, address of deductor should be correctly stated in the statement filed.

- Challan details (BSR code- 7 digits, challan serial number – upto 5 digits, date of tender) mentioned in the statement should be same as those stamped by the bank on the challan counterfoil.

- The challan amount mentioned in the statement should same as the total amount deposited in the bank.

- Valid 10-digit PAN of deductee should be provided.

Hope this will help you in filling TDS Correction Statement, Still any problem, Just Put your Query here below.