Steps to claim Tax exemption through LTA Voucher Scheme for FY 2020-21 on their Leave Travel Allowance (LTA) and Leave Fare Concession (LFC). This will be very useful in saving Income Tax for those with an LTA component in their salary especially for 20% & 30% Income Tax bracket. This can save tax on taxes by spending a specified amount as per the guidelines on certain goods, without having to make any trips.

During the first wave of COVID-19 in 2020, the government had announced certain relief measures for salaried taxpayers. These included the option claim tax exemption on their Leave Travel Allowance (LTA) balance as well as Leave Fare Concession (LFC).

LTA is an additional benefit offered by the employer to their employees to claim tax benefit on LTA for a vacation that has been taken anywhere within India. However, due to the pandemic and periodic lockdowns, taxpayers could not travel. In such cases, they may have to pay tax on the LTA component of their salaries. To help salaried taxpayers avoid this situation, the government announced an LTA cash voucher scheme.

This LTA voucher scheme has been notified on May 5, 2021. Also, it is not eligible for those who opted for the new tax regime.

Also Read – How to Get Tax Exemption for LTC, Leave Travel Concession ?

What is the LTA Voucher scheme?

Key Highlights :

- Under the LTA cash voucher scheme which is only applicable for FY 2020-21.

- Those with an LTA component in their salary, can save tax on taxes by spending a ‘specified amount’ on certain goods with GST of 12% and above, without having to make any trips.

What is the eligibility of claiming Tax rebate through LTA voucher scheme ?

- The taxpayer or a member of his/her family should have incurred the ‘specified expense’ as specified in the list.

- The purchases must be made under Online Mode only.

- It should have been spent on purchase of goods and services with a GST rate of 12 percent or more.

- The purchase must have been made between October 12, 2020 and March 31, 2021.

- The maximum exemption should not exceed Rs 36,000 per person or one-third the ‘specified expenditure’, whichever is less.

- Payment for the expenses should have been made via electronic means to a GST registered business and a ‘GST tax invoice’ should be available.

- LTA voucher exemption offered for the ongoing block being 2018 to 2021.

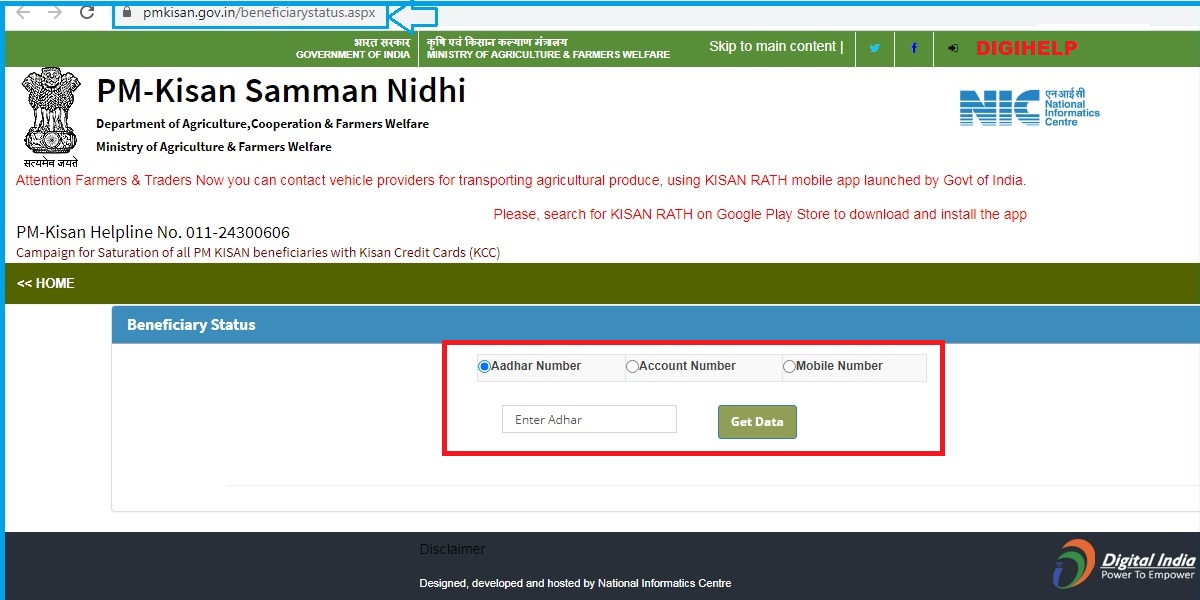

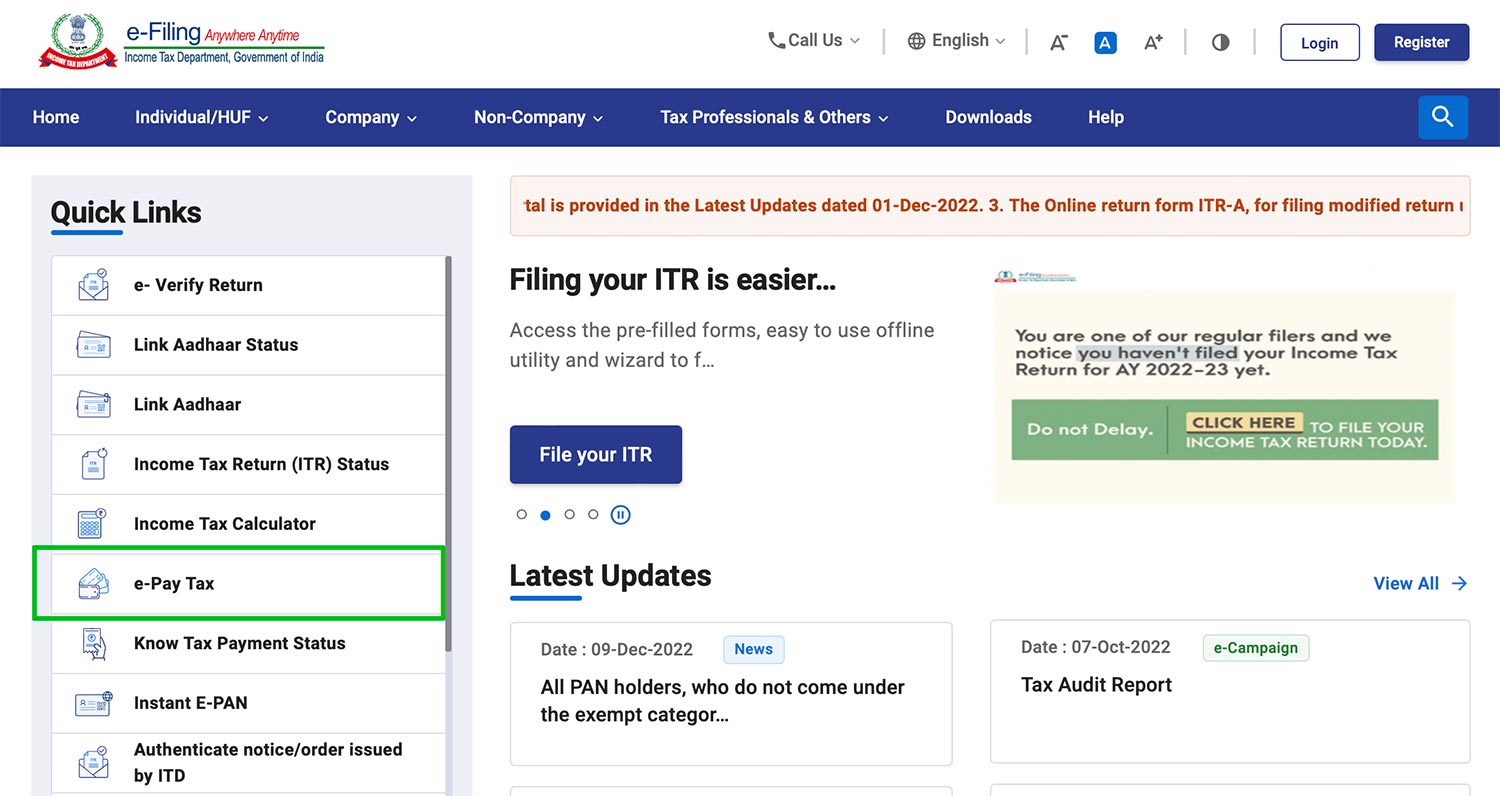

How do I claim this exemption?

- Income Tax for FY 2020-21 was already been deducted by your employer.

- If your employer had not given the benefit as per LTA voucher scheme for FY 2020-21.

- If you haven’t been able to claim the LTA scheme through your employer.

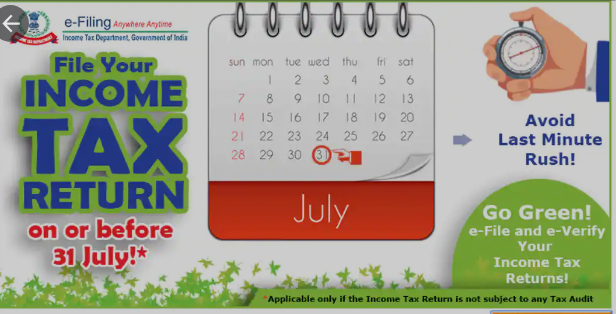

- You can claim it at the time of filing your income tax return.

- Do make sure you meet all the specified conditions and report the LTA exemption that you want to claim in your income tax return properly.

- All the supporting documents must be retained: the tax invoice and the payment proof.

- If you claim this scheme at the time of filing your return, you will be able to claim a refund of TDS deducted on the LTA balance as per the eligibility with maximum of Rs 36000.

- Most employers would have already done one of the two things – deducted TDS on your LTA balance and paid it to you as salary for FY 2020-21 or allowed you to carry forward the LTA balance to the next financial year for making a claim.

- If you bought a mobile phone, an AC or a refrigerator in the specified period, you may be able to claim your LTA as exempt assuming you meet all the conditions listed above, as all of these goods attract a GST rate of 12 percent or more.

- Goods purchased through eCommerce portal or Offline store are eligible but the payment made to them through Digital way only like Credit Card, Debit Card, Bharat QR, Internet Banking, Mobile Banking, UPI, Payment apps etc.

- Those who opted for the new tax regime will not be eligible for LTA voucher scheme.