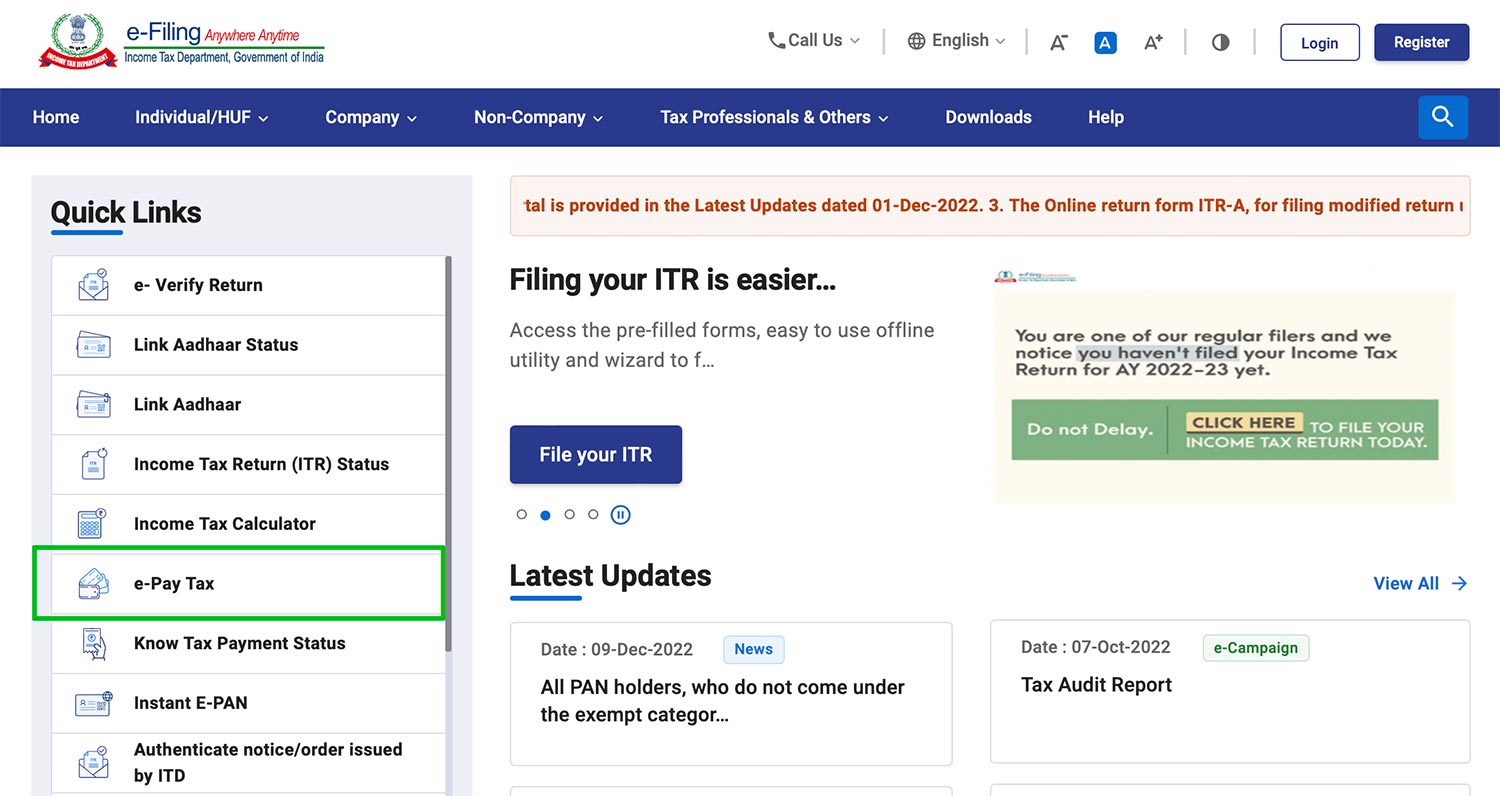

How To Get Income Tax Exemption on LTC/LTA for Bankers ? – Leave Travel Allowance (LTA) or Leave Travel Concession are generally the benefit provided by Bank to their employees. This is the most common perk or benefit provided by almost all the banks in India.

There are numerous occasion when the calculation of LTA/LTC claim create confusion while calculating Income tax. In order to provide the complete details and sorting out the confusion, the details are provided to get the exemption on LTA/LTC. Follow the Instruction below :

As per the rule Leave Travel Concession or Assistance (LTC/LTA), is the benefit extended by an employer to an employee for going anywhere in India along with his family where family is defines as Family includes spouse, children and dependent brother/sister/parents. However, family doesn’t include more than 2 children of an Individual born on or after 01-10-1998.

Read Also : Rail Fare Chart for Claiming LTA/LTC Reimbursement

As per the Section 10(5) of the Income-Tax Act, 1961, Rule 2B, which provides exemption on the LTC/ LTA . There are certain condition while considering the exemption on LTC or LTA. These are

- LTC/LTA exemption are restricted to fare only : The exemption shall be limited to fare for going anywhere in India along with family twice in a block of four years. This is to remember that exemption would cover the actual travel costs incurred by the employee not the total cost of the holidays.

Calculation of exemption would be calculated as :

LTA/LTC Received – LTA/LTC exempted = Tax Liabilities

2. Travel Within India to be considered under Tax exemption.

3. Mode of travel – Exemption are calculated on the basis of mode of fare i.e.

i. Exemption limit where journey is performed by Air – Air fare of economy class in the National Carrier by the shortest route or the amount spent, whichever is less

ii. Exemption limit where journey is performed by Rail – Air-conditioned first class rail fare by the shortest route or the amount spent, whichever is less

iii. Exemption limit if places of origin of journey and destination are connected by rail but the journey is performed by any other mode of transport – Air- conditioned first class rail fare by the shortest route or the amount spent, whichever is less

iv. Exemption limit where the places of origin of journey and destination are not connected by rail:

a. Where a recognized public transport system exists – First Class or deluxe class fare by the shortest route or the amount spent, whichever is less

b. Where no recognized public transport system exists – Air conditioned first class rail fare by shortest route or the amount spent, whichever is less

4. Only two journeys in a block of 4 calendar years is exempted under Income Tax

5. No Income tax exemption if actual travel is not done and LTA is encashed. In such condition full amount will be taxed. Read : How To Pay No Income Tax on Salary ?