Recently Income Tax department has sent notices to thousands of employees regarding non receipt of TDS deducted on their salary. Such notices has created a panic among employees as the TDS are deducted and deposited in government account under stipulated time frame.Recently Income Tax department has unearthed a scam where 447 companies were deducting taxes from their employees but not depositing the amount with the government and instead diverting them for personal or business interests. The scam worth Rs. 3,200 crore.

Tax deducted at Source or TDS is the tax that is deducted from salary by employer and paid to the government against Permanent Account Number (PAN). Employees are also provided with Form-16 at the end of financial year with details of TDS like amount, date of deposit etc.

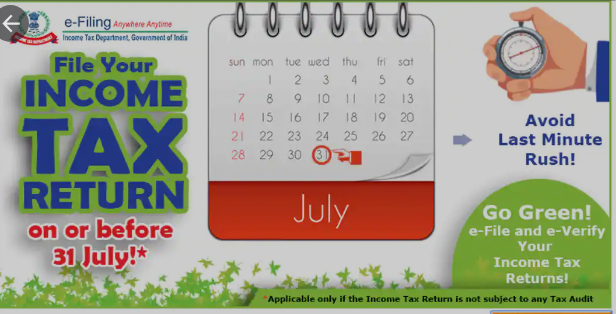

Read – File Your Revised Income Tax Returns By 31st March or Be Prepared to Face Penalty or Prosecution

As per Income tax rules it is the responsibility of employer to deduct and deposit the Income tax on quarterly basis.However, as an employee you may land in trouble if the TDS is deducted but not deposited with the government. You will get a notice from the I-T Department for discrepancies in Form 16 and Form 26AS.

Now, it is important, how as an employee you can check if your TDS has been deposited by employer ? Check out step by step process to verify the Income tax deducted at source (TDS) with IT department. Following these guidelines, you need not to wait for Form 16 from your employer.

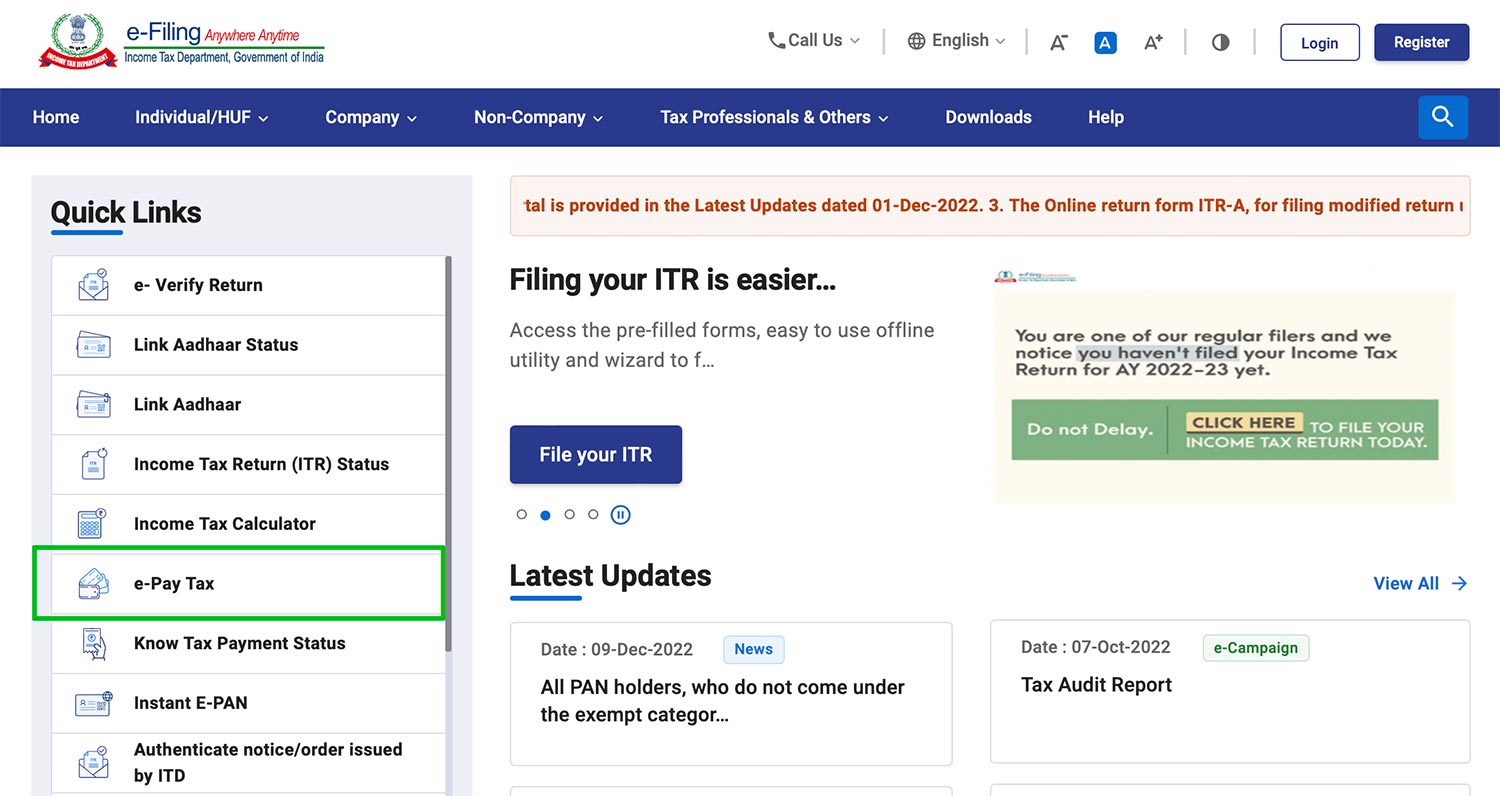

The TDS deducted can be checked quarterly by visiting the income tax e-filing website.

- Login to the income tax filing website using your login and password – http://incometaxindiaefiling.gov.in/home

- Click on the View Form 26 AS tab on the right. This will direct you to TRACES website.

- To download the Form 26As from the TRACES website you have click on Tax Credit (Form 26As option).

- Form 26As can also be downloaded by PAN holders through their Bank’s Internet Banking. You just have to login to your bank’s internet banking website and click on the option provided to view Form 26AS. Read how to register for Internet Banking for all the banks ?