Syndicate Bank Online net banking Login Tutorials – Syndicate Bank is the Oldest and one of the fastest growing Nationalized bank in India. Syndicate Bank was established in 1925 in Udupi. Syndicate bank was among the first bank in India which moved toward the computerization.

Syndicate bank has now more than 2600 branches with ATM at various location in India. Syndicate bank offers a wide range of online services such as- Internet banking, online bill payment, Syn e-Tax, and Money Transfer and lot of other benefit mainly free.

Who can Get the Syndicate Bank Internet Banking ?

Retails Customers :

Individuals, proprietorship, joint accounts where any one of the joint holders can operate are eligible for Internet Banking

Business/Corporate Customers :

H U F, Society, Partnership Concerns, Sole Proprietorship Firms, Partnership Concerns, Public / Pvt. Ltd. Company and Trusts / Govt. Departments are Corporate Internet Banking Users.

According to Syndicate Bank rule the Other customers (companies, partnership firms and accounts with joint operation clause) are also provided passwords with limited roles under Retail Module.

They are allowed to view the accounts and are not given the passwords to undertake the transactions of their own.

Read For Details :

How To Open Syndicate Bank Saving Account (Synd Swayam) Online ?

Key Highlights :

How To Pay Syndicate Bank Credit Card Bill Using NEFT ?

How To Generate Syndicate Bank Green MPIN

How To Reset Syndicate Bank Internet Banking Password ?

Retail Module: Retail module offers the following facilities to the registered Retail customers.

- SyndBillPay: Facility available all over India for payment of SyndCredit Card dues and Policy premiums of LIC of India. Facility of other utility bill payments is available at select centres.

How To Login Syndicate Bank Internet Banking ?

Syndicate Bank Internet Banking support Browsers that support 128-bit encryption to access NetBanking. Internet Explorer 5.5 or above (or) Netscape Communicator 4.7 or above, offer this feature only.

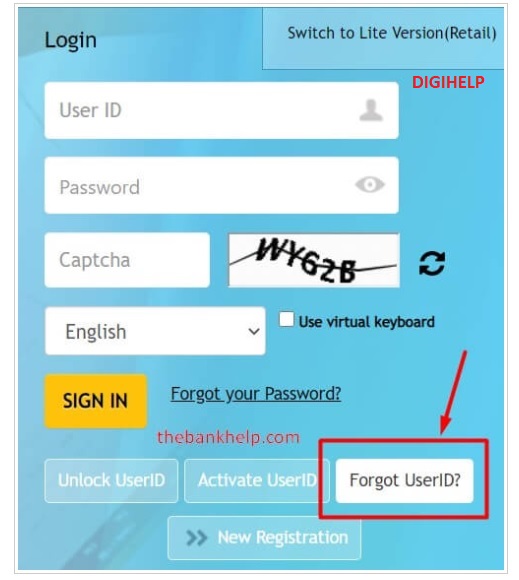

If you already avail the Internet Banking password for syndicate bank e-banking you may follow the below steps. If you don’t have password for e-banking, you need to contact the branch or customer care of Syndicate Bank at below mentioned number to get the password.

You are provided with 2 Password Mailers, one containing ‘Log-in’ Password and the other ‘Transaction’ Password. You have to Log-in to the system using your Customer ID as the ‘User-ID’ and the Internet Banking Login Password as Password.

You can use the transaction “Password” in certain options where financial transactions are involved. After the first login, the system takes you to “change password” screen where there is provision for changing both “Log-in” Password as well as “transaction” Password. Your password should :

- Be minimum of 8 characters and maximum of 16 characters.

- Contain at least 3 digits

- Contain at least one lower case and one upper case alphabet.

You can also change the Passwords using change password option, which is available separately in the Menu.

[button color=”red” size=”big” link=”https://www.syndonline.in/B001/ENULogin.jsp” target=”blank” ]Click To Login Syndicate Bank Internet Banking[/button]

FACILITIES AVAILABLE UNDER SYNDICATE BANK INTERNET BANKING:

Retail Module: Retail module offers the following facilities to the registered Retail customers.

- SyndBillPay: Facility available all over India for payment of SyndCredit Card dues and Policy premiums of LIC of India. Facility of other utility bill payments is available at select centres.

- Account Related Functions:

- Viewing Account Summary

- Viewing Account Details

- Tracking of unclear funds

- Viewing Account Activity

- Funds Transfer

- Funds Transfer within the accounts of the customer

- Beneficiary Maintenance

- Third Party Funds Transfer within accounts in Syndicate Bank

- NEFT Transfer to any bank in India

- RTGS fund transfer to any bank in India

- Beneficiary Maintenance

- Term Deposit Functions

- Viewing Term Deposit Details

- TD Pay Out Instructions

- Opening of Term Deposits

- Modification of Term Deposit Terms

- Redemption of Term Deposits

- Loan Account Functions:

- Viewing of Loan Details

- Viewing Loan Account Activity

- Making Loan Repayments

- Closure of Loan Accounts

- Standing Instructions Functions:

- Viewing existing Standing Instructions

- Modification of Standing Instructions

- Initiate new Standing Instructions

- Other Services:

- Cheque Book Request

- Cheque Status Inquiry

- Stop Cheque Request

- Bankers Cheque Request

- Demand Draft Request

- Forex Rates Inquiry

- Interest Rates Inquiry

- Viewing of Session Details – current and 3 previous logins

- Change Password facility

- Payment of Indirect Taxes (Excise and Service Tax)

CUSTOMER SERVICE OPTIONS:

- ChequeBook Request: You can request for ChequeBook and the branch will despatch it by Courier. The number of cheque leaves despatched will depend on the branch assessment.

- Cheque Status Inquiry: You can know the status of the cheque issued. On keying in the Cheque number the status of the cheque will be displayed as ‘Paid’, ‘Unpaid’ ‘Stopped, ‘Lost’.

- Stop Cheque Request: You can stop cheques by giving the reasons for the same.

- Bankers’ Cheque Issue: You can request for issue of Banker’s Cheque by filling in all the required details and also the delivery mode such as “On hold”, “Mail to Remitter” and “Mail to Beneficary”. The Branch will debit your account and mail it to remitter or beneficiary as indicated. In case of “On hold” delivery mode, you have to collect the same from the branch concerned.

- Demand Draft Request: You can request for a Demand Draft as per procedure prescribed above.

- Forex Rate Inquiry: You can view the Foreign Exchange Rates for various currencies under Cash Buy / Sell, TT Buy/Sell, and TC Buy/Sell. The Rates displayed under this option are only indicative. For finer rates for any specified operation you have to contact the branch.

- Interest Rate Inquiry: You can view the Interest Rates offered by the Bank for various Deposit Products as on the date of viewing.

- Bulletins: You can view the important announcements made by the Bank from time to time.

- Mailbox: Please visit this option every time you Log-in to check whether the Bank has any specific message for you. You can also reply to the Bank if you so desire.

- Change Password: You can change either the login password or the transaction password as and when you desire. However, you cannot use any of the passwords used in the 5 preceding occasions.

- Session Summary Report: You can view the activities performed during a session. There is a provision to view the sessions summary for your previous 3 logins.

[button color=”red” size=”big” link=”https://www.rajmanglam.com/news/reset-syndicate-bank-internet-banking-password.html” target=”blank” ]How To Reset Syndicate Bank Internet Banking Password ? Click[/button]

Customer Care Number of Internet Banking of Syndicate Bank

Call : Help Desk No. 1800 425 5784 (Toll Free) / 080 25705784

Mail : syndinet@syndicatebank.co.in

If still you are facing problem , Just Put your query here below :

![[Fixed]- Union Bank of India, UBI Internet Banking Not Working](https://www.rajmanglam.com/wp-content/uploads/2021/01/Union-Bank-of-India-Internet-Banking.jpg)

![[Resolved] – SBI Error No Accounts Mapped for This Username](https://www.rajmanglam.com/wp-content/uploads/2020/09/SBI-No-Accounts-Available-for-the-User-1.jpg)

I have Net Banking in Syndicate Bank,I forgot-ted my transaction password ,then how can I get new Transaction password.

Can anybody help me?

contact branch with written application

i got password for login and transaction.and both password are changed. Now only account summary show account number. No other service like account details, account activity, and customer service show my account number and it shows no account is available. I am also not able to add third party for NEFT transaction, fund transfer. Beneficiary Maintenance is only for syndicate bank customers. For other bank how can i add not mentioned.

Sir, Iam AJAY. my current a/c no-06593070001057, pl give me a new tranction passoward for neft fund transfer. my old tr-passward not working. give me a feedback as earlist. thanking u sir,

CONTACT NEAREST BRANCH WITH REQUEST APPLICATION WRITTEN ON YOUR PAD..

Sir, I am ajay, from doddaballapur, i wl unable to transfer funds through neft due to transction passward no working kindly give me a correct information aganist new tr-passward ajay. 13/12/2012

Hi

I have an savings account with Syndicate bank. I would like Internet banking faciliy. Please provide Password etc.

CONTACT UR BRANCH