There are number of times investor fails to encash a redemption or dividend cheques. Once the redemption failed to encash it becomes invalid and the amount is categorized as unclaimed. Reason for failed payment could be several as like change in address of the investor, name mismatch in bank account and AMC’s records or Non CBS/full account number or stale cheque,Demand drafts.

But in case of demise of the investor, if there is no claimant and/or no information to AMC about the demise of the unit holder, the investment will continue in the folio and will not be categorized as unclaimed.

Read : Now e-wallets Companies Can Sell Mutual Fund Online

How Does Mutual Fund Companies use the Unclaimed Money ?

SEBI guidelines states that, the Asset Management Company (AMC) may invest unclaimed funds, including redemption and dividend, in the call money market or money market instruments or a liquid scheme or money market mutual fund scheme, specially floated by the AMC for deployment of unclaimed amounts. In personal opinion this is the reason for higher Unclaimed investment lying with Mutual fund companies as they don’t bother to search and pay the claim as in banking sector. SEBI dictates 10 days time frame to pay the redemption to investors.

When Can Investors Claim their Money Back ?

Investors can claim their unclaimed funds anytime. The time frames defined are :

1. If an investor makes a claim within three years from due date of redemption or dividend, he is eligible to receive initial unclaimed amount along with the income earned on it during the period.

2. If an investor claims it after three years, the initial unclaimed amount along with the income earned on it till the end of third year after due date of redemption or dividend will be paid.

3. Income earned on the unclaimed money after the third year shall be transferred to Investor’s Education and Protection Fund (IEPF), which is used to spread financial education and awareness. Once the amount is transferred to IEPF, it cannot be redeemed.

Read : How To Link Mutual Fund eKYC with Aadhaar ?

What is the procedure to claim the money?

Investor can follow the below instructions for claiming the redemption amount :

- Investors can submit a duly filled ‘Unclaimed Redemption/ Dividend Claim Form’ along with updated bank details to receive the unclaimed funds back.

- SEBI has made it mandatory for AMCs to provide the details of unclaimed investment on their websites.

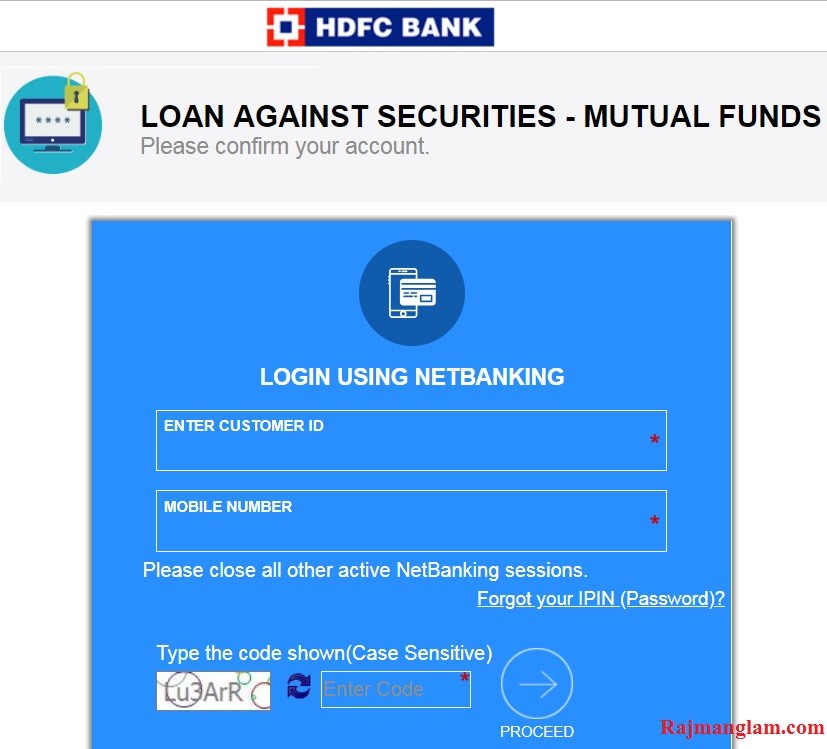

- An investor can check unclaimed sum, if any, by simply putting his folio number on the AMC’s website.

- If the investor does not remember his folio number, he may go to the website of the registrar –-CAMS or Karvy –– to check the unclaimed money status by inserting details like PAN number and email id or mobile number or bank account details.

Read : Why ELSS Is A Better Tax Saving Option Than Others ?

Inputs from ET