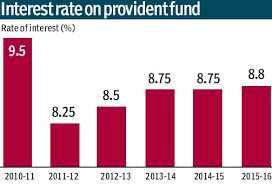

Know How To Utilize the EPF Rate Hike for FY 2015-16 announced by government on Employee’s Provident Fund (EPF) ? Government has decided to hike the Interest rate on EPFO from 8.75% to 8.80%, an increase of 0.05% for this financial year.

EPFO is the salary portion which is contributed as 12% portion of their basic pay of each month. Employee’s get the equal contribution from the employer on deducted fund. A part of the employer’s contribution goes to the Employees’ Pension Scheme.

Employees get the interest on this contributed fund at the rate announced by central government which is currently hiked to 8.80%.Any salaried individual may contribute any amount they wish on the salary above Rs 15,000.

NO Tax on EPF Contribution or Withdrawal

There is a tax relief up to Rs 1.50 lacs under 80C of income tax. The interest that your fund accumulates along with the contributions made are tax-free on withdrawal if you withdraw after at least five years of continuous service in any organization. Only condition is the same PF account have been used if you change jobs.

How To Utilize the Hike in EPF rate ?

This is the important question, just follow the instruction

- EPF is a good long-term investment for salaried. EPF get the equal contribution from employer and get the interest benefit on it. A corpus of fund at the longer time frame.

- Universal Account Number (UAN) helps in transferring the amount online. Read How To Transfer Fund to PPF account Online ?

- The EPFO has also decided to invest about 5% of the incremental corpus in equities as ETF. There are chances of growth in corpus fund in long term.