Know the process to Submit LIC Insurance Claims Online – the Life Insurance Corporation of India (LIC) has started an online claims facility where you can register a claim through its portal. The new initiative will be hassle free for millions of the customers. It may probably iron out all the delays and glitches in claims settlement.

The list of services which are offered by LIC online through its portal are :

Key Highlights :

- 1 The list of services which are offered by LIC online through its portal are :

- 2 How To Submit LIC Insurance Claims Online ?

- 3 List of claims would be accepted under this service?

- 4 Proof of submission for LIC Insurance Claims Online

- 5 What are the documents needed for registering a death claim online?

- 6 How many documents need to be uploaded?

- 7 Make it Popular:

- Death claim registration

- Request for maturity and survival dues

- Annuity registration and existence certificate submission

- Policy revival after it lapses and

- NEFT mandates are made available online.

- You can upload the requisite documents online.

- Death, survival benefit and maturity claims,

- Revival of policies and annuity plan procedures, including existence certificates can be submitted online.

How To Submit LIC Insurance Claims Online ?

Know the step by step process to submit the insurance claims online. you would have to register with the portal to submit documents and make claims online.

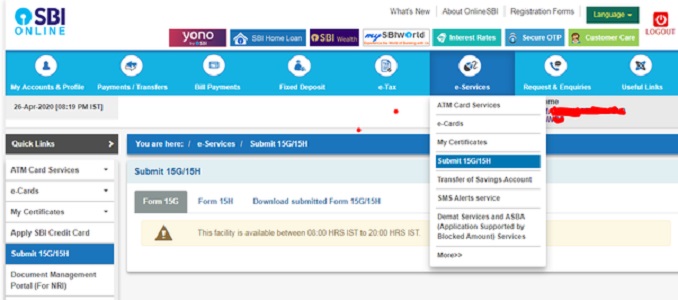

Step 1: Login to the website: www.licindia.in

Step 2: Select the option LIC Online Service Portal or click here

Step 3: Register yourself if not done earlier.

Step 4: Select the type of claim or service you seek.

Step 5: Fill the requisite form and submit it with other supporting documents.

List of claims would be accepted under this service?

- Death, survival benefit and maturity claims,

- Revival of policies and annuity plan procedures, including existence certificate can be submitted online.

- Different forms need to be downloaded and filled as per instructions.

- You can even set up NEFT, NACH mandates. AADHAR seeding for policies too can be done through the online service.

Also Read – How To Pay LIC Insurance Premium Online ?

Proof of submission for LIC Insurance Claims Online

Upon successful registration for e-services, users would get an acknowledgement SMS and e-mail based on details mentioned in the registration form. Verification of the same would be done by the LIC zonal office within the next three days. A confirmation of acceptance would again be sent via email and SMS, after which you can intimate your claims or access the new services online.

What are the documents needed for registering a death claim online?

For a death claim, the legal heir or nominee mentioned in the policy should submit the documents including:

– Claim Form ‘A’ in Form No.3783. (Print this, sign and scan)

– Death certificate.

– LIC Policy document (original).

– Deed of assignment (if any).

How many documents need to be uploaded?

For LIC Insurance Claims Online, Only a maximum of six documents can be sent through this facility. These documents can be:

- Policy Bond first and last page

- Wherever NEFT is not there, then NEFT Mandate form along with the cancelled cheque

- PAN card and another Identity- and address proof.

- Form number 3510 declaration regarding Non assignment (in case of loans or policy pledging)

NOTE : Format of the scanned image should be preferably in .jpg or .jpeg format. However, images with the following formats can also be uploaded: .bmp, .png, gif, .tiff. The maximum image size should be 100 KB.