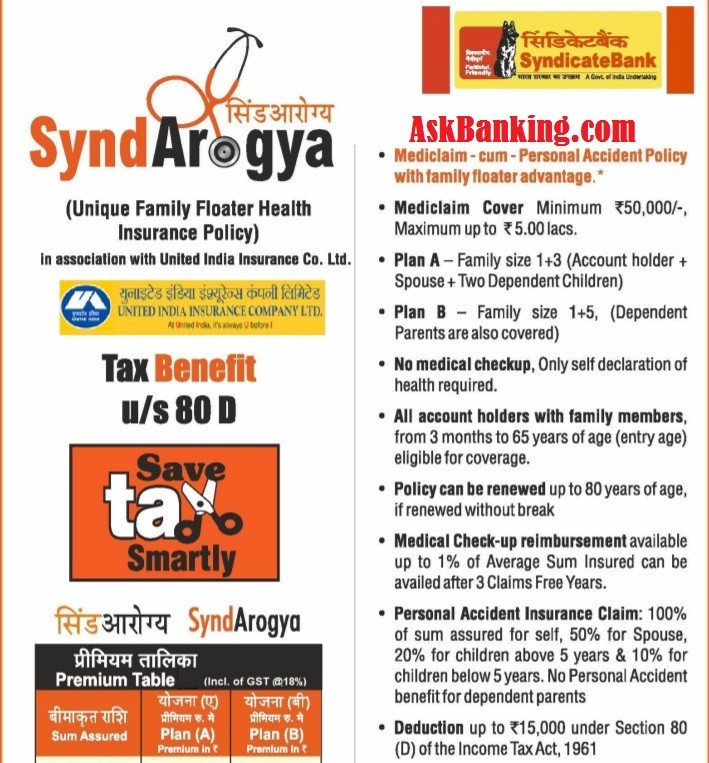

Know the option to continue the Synd Arogya Benefits with existing policy with Canara Syndicate Bank – Syndicate Bank has discontinued the Synd Arogya healthcare policy which was offered to their customer in association with M/S United India Insurance Company Limited (UIICO) since 1st April 2020. Syndicate Bank had issued a public notice in this regard on their website here . There are many customers who are availing this facility for long and still wanted to continue. Canara Bank which has amalgamated the erst while SyndicateBank, now offering the various healthcare policies along with various insurance companies like Bajaj Allianz, Tata AIG etc.

Read – How To Renew Synd Arogya Health Policy Online ?

Bank has taken care of the long association of their customers and provided the option to renew the existing policy with enhanced features and Synd Arogya Benefits. The renewal option will be provided to all the policies where renewal is pending since 1st April 2020.

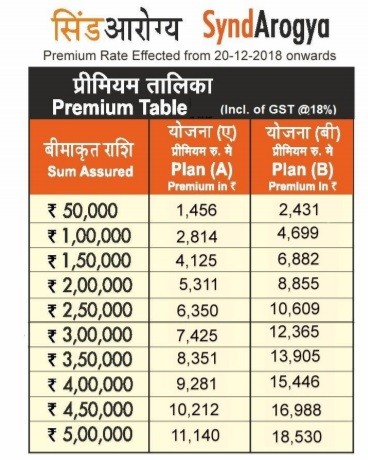

All “Synd Arogya” policyholders that M/s.United India Insurance Co Ltd has served 90 days notice of withdrawal of the existing “Synd Arogya Group Mediclaim Policy” due to various market strategies and the relevant IRDAI regulations. It is also informed that the existing “Synd Arogya Group Mediclaim Policy” will no longer be available in the market from 31st March 2020. Further, during this period, existing policyholders may renew their policies expiring before 31st March, 2020. However, no fresh proposals will be accepted from 13th December 2019

Synd Arogya Benefits – Features offered by Bajaj Allianz

Key Highlights :

| Features | Particulars |

| Sum Insured options | 50K/1/1.5/2/2.5/3/3.5/4/4.5/5 Lakhs |

| Plan Type | Floater |

| Family definition | Self/Spouse/Dependent Children/Dependent Parents or Parents-in-law |

| Entry Age eligibility Adult | 18 to 65 yrs |

| Entry Age eligibility Child | 91 days to 25 yrs |

| Renewal Age eligibility | Lifetime |

| Room Rent sub limit | Actual |

| ICU Sub limit | Actual |

| Day Care procedures | 182 Daycare procedures covered |

| Pre policy medical test | NA |

| Pre hospitalization | 60 Days |

| Post hospitalization | 90 Days |

| Ambulance expenses | Up to Rs. 1000 per policy period |

| Health Checkup | 1% of Sum Insured after 3 claim free years |

| Daily cash allowance | Only for single parent/Guardian accompanying an insured child below the age of 12 years |

| Maternity expenses | Up to 5% of Base Sum Insured |

| New born baby cover | Covered as part of Maternity Expense |

| Funeral Expense | Up to Rs. 1000 per policy period |

| Policy period | 1 year |

| PED waiting period | 36 months |

| Specific diseases waiting period | 24 months |

| 9 Specified disease waiting period | 48 months |

| Maternity waiting period | 9 months |

| 30 days waiting | Yes |

| Personal Accident Rider (Accidental Death Only) | Covered |

Synd Arogya Benefits – Premium Payment Rate Chart for Bajaj Allianz Health Insurance Policy

PLAN – A ( 1+3) [Self+spouse+2 dependent children] , GST Included

| Sum Insured | Premium |

| Rs 50,000 | Rs 3859 |

| Rs 1,00,000 | Rs 7458 |

| Rs 150000 | Rs 10932 |

| Rs 200000 | Rs 14075 |

| Rs 250000 | Rs 16827 |

| Rs 300000 | Rs 19675 |

| Rs 350000 | Rs 22130 |

| Rs 400000 | Rs 24594 |

| Rs 450000 | Rs 27061 |

| Rs 500000 | Rs 29522 |

Synd Arogya Benefits – PLAN – B ( 1+5) [Self+spouse+2 dependent children and parents / Parents in law] , GST Included

| Sum Insured | Premium |

| Rs 50,000 | Rs 6442 |

| Rs 1,00,000 | Rs 12451 |

| Rs 150000 | Rs 18237 |

| Rs 200000 | Rs 23465 |

| Rs 250000 | Rs 28115 |

| Rs 300000 | Rs 32767 |

| Rs 350000 | Rs 36849 |

| Rs 400000 | Rs 40933 |

| Rs 450000 | Rs 45019 |

| Rs 500000 | Rs 49103 |

Customers may choose option of their choice as per their eligibility and capacity. Don’t forget to rate the policy also:

It has increased by 3 times

Visitor Rating: 3 Stars