Step by step process to activate India Post Internet Banking and Registration process – Indian Post is now online and providing online Digital Services to their customers. Know the process to register and activate the India Post Internet Banking Services. The Internet Banking services provide online transactions in many of the Post office savings scheme such as NSC, PPF and KVP.

Post Office Savings Bank (POSB) accounts is now redesigned for digital services like Internet Banking, Mobile Banking and Debit Cards. Customers can now easily transfer funds from the Post Office accounts using internet banking.

Requirements of Activating the India Post Internet Banking

Key Highlights :

1. Active post office bank account

2. You will need an active mobile number.

3. Make sure all KYC documents in order.

4. You need a PAN number and an email ID for communication.

How to Activate India Post Internet Banking ?

- Visit the post office internet banking or download application form here— https://www.indiapost.gov.in/VAS/Pages/Form.aspx.

- Submit the filled form with required documents at your branch.

- A person will receive an SMS alert once internet banking is activated.

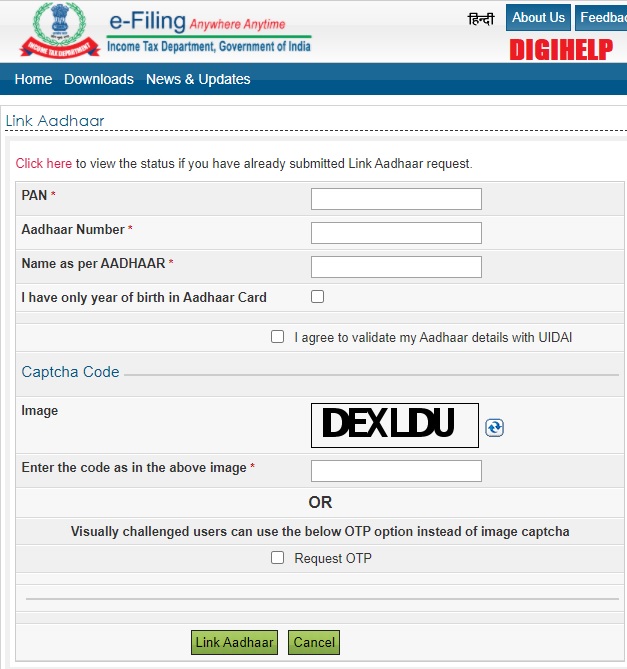

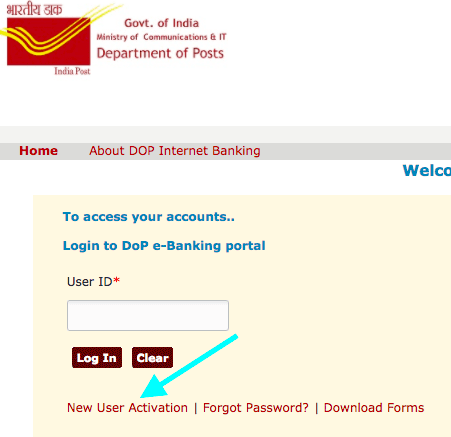

- The next step after receiving the SMS is to visit https://ebanking.indiapost.gov.in and then click on ‘New User Activation’.

- You will have to enter Customer ID which is the CIF ID printed on the first page of the passbook.

- The account ID is the savings account number.

- After successfully completing all of these steps your internet banking account will be activated and you can make fund transfer from the Post Office account.

- Also, you don’t need to visit the branch to deposit money in your PPF account or the post office recurring deposit (RD) account.

How to Enable the Internet Banking Password ?

- One needs to enter the password carefully as after 5 wrong attempts, the user id will be disabled.

- To get the login rights enabled again, one has to send a mail to dopeBanking@indiapost.gov.in from the registered e-mail ID mentioning the details along with CIF/User ID.

Also Know – How To Get Post Office Internet Banking Customer Id ?

India Post Internet Banking FAQs

- 1. What is the URL for DOP internet Banking?The URL for accessing DOP Internet Banking is https://ebanking.indiapost.gov.in

- 2. What are the pre-requisites for availing DOP Internet Banking?

- Valid Active Single or Joint “B” Savings account standing at CBS Sub Post Office or Head Post Office.

- Accounts standing at Branch Post Office are not eligible for availing Internet banking facility.

- Provide necessary KYC documents, if not already submitted

- Valid unique mobile number

- Email address

- PAN number

- 3. How to register for DOP Internet Banking?Visit your home branch, fill the pre-printed application form and submit with required documents.Your DOP internet banking will be enabled by the Post Office and get activated from the next working day.

- 4. How will I come to know about my DOP internet banking activation?Once the request is processed successfully, an SMS alert will be delivered to your registered mobile number within 48 hours

- 5. What is my customer ID?Customer ID is the CIF ID printed on the first page of your Passbook.

- 6. What should be done once I receive an SMS alert regarding DOP InternetBanking activation?Open the DOP Internet banking page using the URL mentioned in the SMS and use the hyperlink “New User Activation” in the home page. Fill the necessary details and configure your Internet Banking login password and transaction password. Now login and configure security questions and answers along with Passphrase. These two steps are mandatory for successful activation of your internet banking user ID.

- 7. Why should I configure Security questions and answers during first time login?Security questions and answers are required to be used when you forget your Login or transaction password or both.

- 8. Whether both login and transaction passwords can be same?No, it cannot be same.

- 9. What is the permissible limit for wrong login/transaction password attempts?5 times

- 10. What if I type my login password or transaction password wrong for 5 times?In case login password is entered wrongly 5 times, your user ID will be disabled from logging in. In case the transaction password is entered wrongly 5 times, transaction rights will be disabled.

- 11. What is the procedure to get my login rights or transaction rights enabled?Please address the issue by mentioning the CIF ID/User ID to dopebanking@indiapost.gov.in from your registered email ID with the issue details.

- 12. What if I forget my password?Use forgot password?link in the eBanking home page. Below options are available to reset the password. Follow the instructions prompted by the applications during reset.

- Using Security Questions and Answers

- Using Account Number and Date of Birth

- 13. Can I view all the accounts of the Joint Holder in Internet Banking?Joint accounts can be viewed if both the customer IDs are linked for the same account. But Single accounts of a joint holder can be viewed by that account holder only in their internet banking login.

- 14. What if my password expires during login?DoP eBanking application will prompt you to change the password during login and follow the displayed instructions

- 15. Even after entering right password, application is not allowing to logging in. What should I do?If user has not logged in for more the 180 days, password will get expire and the same should be intimated via email to DoP ID dopebanking@indiapost.gov.infrom your registered email ID or through the customer care helpline for further guidance.Once the same is enabled at DoP level, an email will be sent to your registered email ID. After getting the user id enabled, Use forgot password link available in the home page and follow the instructions.

- 16. Can my user ID be changed?Yes, the user ID can be changed only once under My profile > Update channel login ID option

- 17. What if I forget security questions and answers and password?Use the option Using Account Number and Date of Birthto reset the password under Forgot Password link available in the ebanking home page and login to the ebanking application. Once logged in successfully, update the security answers as per your requirement.

- 18. What if some of my Post office accounts are not visible in my internet banking login?Please visit the home branch PO of that account to change the customer ID/CIF ID with the eBanking registered CIF/Customer ID

- 19. Can I transfer funds and make deposits?

- Funds can be transferred from your POSB account to other POSB accountsbelonging to you or a thirdparty.

- PPF Deposit and PPF Withdrawal

- RD deposit, Repayment of RD half withdrawal

- SSA deposit.

- 20. What type of accounts I can open through internet banking?RD and TD accounts can be opened through Internet Banking available under General Services > Service request > New request option.

- 21. How to add the nominee for the account opened online through InternetBanking?The nomination which exists in the SB account will get registered for the accounts opened online

- 22. What is the procedure to change the nomination for the accounts opened online?Please visit the Post Office where CIF/Customer ID stands for getting the nomination changed and submit application for change of nomination.

- 23. What type of account can be closed online?RD and TD accounts can be closed or pre-closed as per the existing POSB norms. The closure proceeds will be credited to the SB account.

- 24. Can I register a stop cheque request?Yes, under General Services > Service request > New request option- Savings Accounts – Stop Cheque

- 25. Can I change my login or transaction password?Yes, it can be changed under My Profile > Change Passwords option

- 26. Can I schedule a fund transfer for future date?Yes, you can schedule fund transfer once by selecting frequency type “Single” and multiple times by selecting frequency type as “Recurring” for PO savings bank accounts only.

- 27. Can I take PPF withdrawal online?Yes, it can be availed for eligible amount

- 28. Can I take RD half/partial withdrawal online?No, it can be availed for eligible amount/period at home branch PO only

- 29. How can I disable my DOP Internet Banking?Approach home branch PO for disabling Internet Banking.

- 30. How do I get the passbook for RD / TD accounts opened through EBanking?Account can be closed online as well as statement is available in ebanking. If customer desires passbook, the customer should approach the home branch (where the CIF ID is attached), identify himself and provide the account number(s) opened online, to get the passbook(s).

- 31. How can I get support from DoP for any issues regarding eBankingoperations?Please call our customer care toll free number 1800-425-2440 between 9 AM to 6 PM for any assistance or you can write to us on our email ID dopebanking@indiapost.gov.in

- 32. Why after entering user ID Pass phrase is shown every time when I try to login to DOP eBanking URL?Pass phrase is security add on feature, which confirms that you are logging into genuine DOP Internet Banking URL. It should always match with the phrase which you have configured during your user activation and then proceed with login credentials. This helps you in identifying identical malicious links whose primary objective is to steal your personal data

- 33. What if my Pass phrase does not match during login?Do not enter the password and do not proceed further logging in to such site as that may be a malicious site. Report such malicious URLs immediately to our email dopebanking@indiapost.gov.in

- 34. Can I change the Pass phrase?No, Pass phrase can be configured only once during activation of Internet Banking.

- 35. My session frequently times out when I am logged into eBankingapplication. What should I do to prevent this?For security reasons, if your login session is idle for more than 5 minutes, it will automatically log you out. Please enable pop ups for our eBanking URL, which will alert you to extend the session during last minute of your session. Alternatively, you can use “Prevent Session Timeout” hyperlink in your login to extend your session.

- 36. Where can I download eBanking activation application form?Please visit our official website in the following URL: https://www.indiapost.gov.in/VAS/Pages/Form.aspx under saving bank category “ATM or Intra Operable Net banking Mobile Banking Request Form“ is available for download

- 37. How to completely logout from my eBanking login?After clicking on logout once, our eBanking application will take you to additional page, where you have to click on logout once again to completely log you out from eBanking application.

- 38. What should I do to activate my eBanking, if my account stands in the PO other than the place where I am residing?Please visit nearest PO to transfer your account and then apply for eBanking by submitting the prescribed application form, post transfer-in.

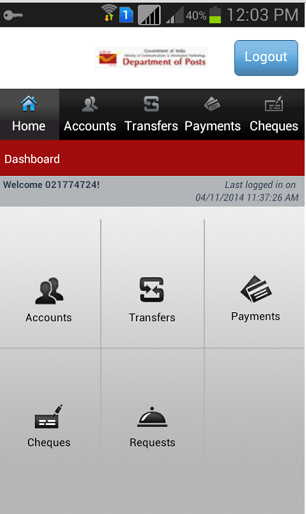

- 39. Can I place a request for new ATM card in DoP Internet Banking app?No, New ATM Card request cannot be placed in Internet Banking. However, it can be placed in DoP Mobile Banking app Dashboard under : Request –> New ATM Card Request

- 40. How to request for ATM PIN in DoP Internet Banking app?No, New ATM PIN request cannot be done in Internet Banking. However, it can be placed in the Mobile Banking app Dashboard as under:

- Request –> ATM PIN Request

- 41. How do I add Beneficiary in the DoP Internet Banking?Beneficiary can be added under the Menu Transactions> Transaction Support Services > Manage Payee > Add Counterparty

- 42. Can I view the added Beneficiaries in DoP Internet Banking?Yes, can be viewed under Transaction Support Services > Manage Payee > View Payee