Know the way to add customer GST Number in Flipkart invoices – You are purchasing from Flipkart for end consumption and want invoice from the seller with GST details of your employer. This will be very helpful in such cases where employees are getting the reimbursement from the employer for mobiles or furniture items i.e. Furniture facilities for bankers, Central government employees etc. Further PayTM Mall allows you to give your GSTIN while purchasing so one can avail the input tax benefit from Paytm app but not Amazon. You need business account with Amazon to add your GST Number.

Can a Flipkart customer add his GST number to the invoice ?

Key Highlights :

As per GST guidelines, It is not mandatory for suppliers to include the customer’s GST number on invoices meant for retail sales. Due to this the local sellers does not put your GST details on their bill. Flipkart and others online players have a specific B2B section where you can see goods where you will get a tax invoice. If you order using that option and provide your GST details you will get an invoice. But otherwise, if you decide to add the details on your own after getting it from the supplier sorry that is not valid, but if you purchase the product from the Flipkart for end consumption, seller may give you an option to add your GST.

How to add customer GST Number in Flipkart ?

Follow the below steps to add your GST number in Flipkart invoice.

- Visit the Flipkart mobile app,website or Click here

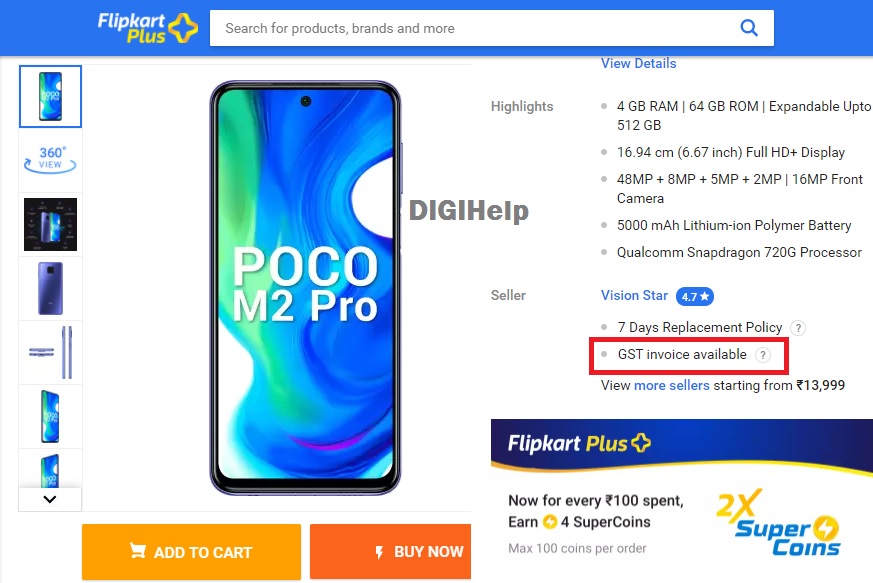

- Search for any product and click on ‘Buy Now’

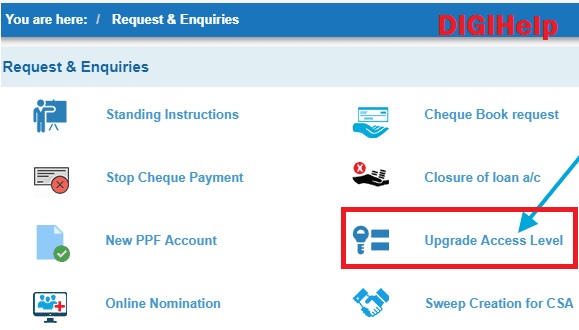

NOTE : Adding GST number is not applicable with all the sellers on Flipkart. You need to verify it before purchasing from the seller whether it is showing ‘GST Invoice Available’ option or not at the location mentioned in the above image.

Also Read – How to apply EMI on SBI Debit Card for online purchases ?

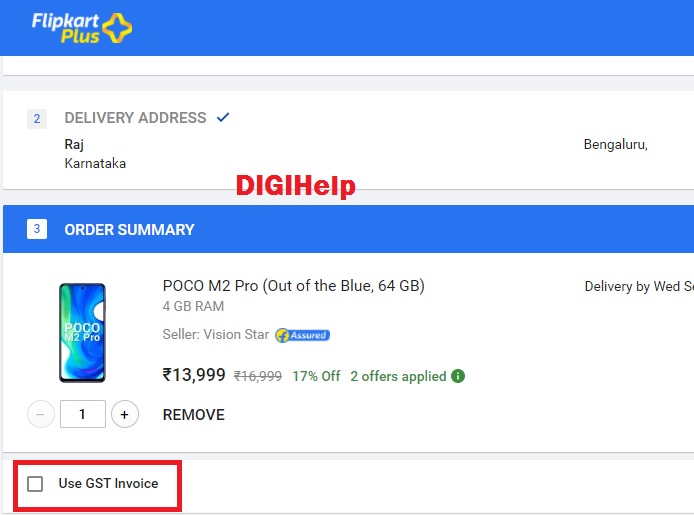

3. Choose the Delivery Address

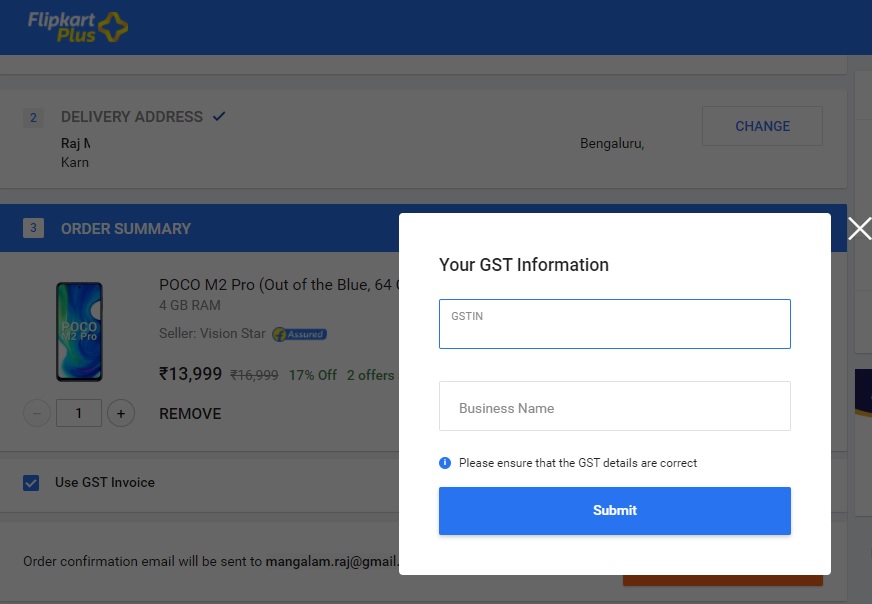

4. Go to Order Summary and Click on the box ‘Use GST Invoice’

5. Add your GST Number and Organization name correctly

6. Click on Submit

That’s Done ! You will get the invoice with your GST details.

Terms & Condition : Flipkart

Users with registered businesses may purchase products for their business requirements offered for sale by sellers on the Platform. Provided, however, purchases on the Platform must only be for end consumption. Users must not use products purchased on the Platform for any commercial, promotional, resale or further distribution purposes.

-

For purchase of all such products, a Tax Invoice including the GSTIN provided by User (” GST invoice“) shall be provided to the User, which will have, inter alia, the following details printed on it:

- GSTIN associated with the registered business of the User as provided by the User

- Entity name of the registered business of the User as provided by the User

-

Please note that not all products are eligible for GST Invoice The products having a ‘GST Invoice eligible’ callout on the Product Detail Page of the Platform will be eligible for GST invoicing.

-

GST Invoice will not be eligible on the following product(s):

-

if Value Added Services like Complete Mobile Protection, Assured Buyback, Installation services are attached to the products

-

if the products are bought along with an exchange offer

-

-

Please note that the GST invoice shall contain the details of User’s GSTIN and business entity name as provided by the User. Users should ensure that the details entered by them are accurate. Flipkart and Seller shall not entertain any request for any revision in the GST Invoice. Flipkart and Seller shall not be liable for any default on User’s part including for reasons associated with details provided by the User.

-

Please note that Flipkart is not liable in any manner whatsoever in relation to the GST Invoice or any input tax credit associated therewith.

-

For seamless availment of input tax credit, kindly select the address which is mentioned as the registered place of business as per the records of GST authority. Please note that availment of input tax credit is subject to provisions of GST Act and rules.

-

The delivery and billing addresses will be required to be the same, please note that input tax credit will be denied by GST authority if the delivery address and GSTIN in the GST invoice are of different states.