Reliance SBI Credit Card PRIME Reviews, Features & Benefits – India’s largest retailer Reliance Retail has launched the Co branded credit card with SBI Cards exclusively for providing benefits on shopping with reliance brands like Reliance retail outlets spanning various sectors, from fashion, Lifestyles, Tends, Groceries, Pharma and Jewelry.

Features & Benefits

- Get Reliance Retail voucher worth of Rs. 3,000/- on payment of joining fees

- 10 Reward Points per Rs. 100/- spent on the participating Reliance Retail Stores.

- 1 Movie ticket a month worth Rs. 250/-

- 8 complimentary Domestic Airport Lounges per calendar year (max. 2 per quarter)

- 4 complimentary International Airport Lounges per calendar year (max. 2 per quarter available from 15th Dec’23 onwards)

- 1% fuel surcharge across all petrol pumps in India, for transactions between Rs. 500/- and Rs. 4,000/-, exclusive of GST and other charges

Fees & Charges

- Annual Fee (one-time): Rs. 2999 + GST

- Renewal Fee (per annum): Rs. 2999 + GST

- Add-on Fee (per annum): Nil

Final Verdict

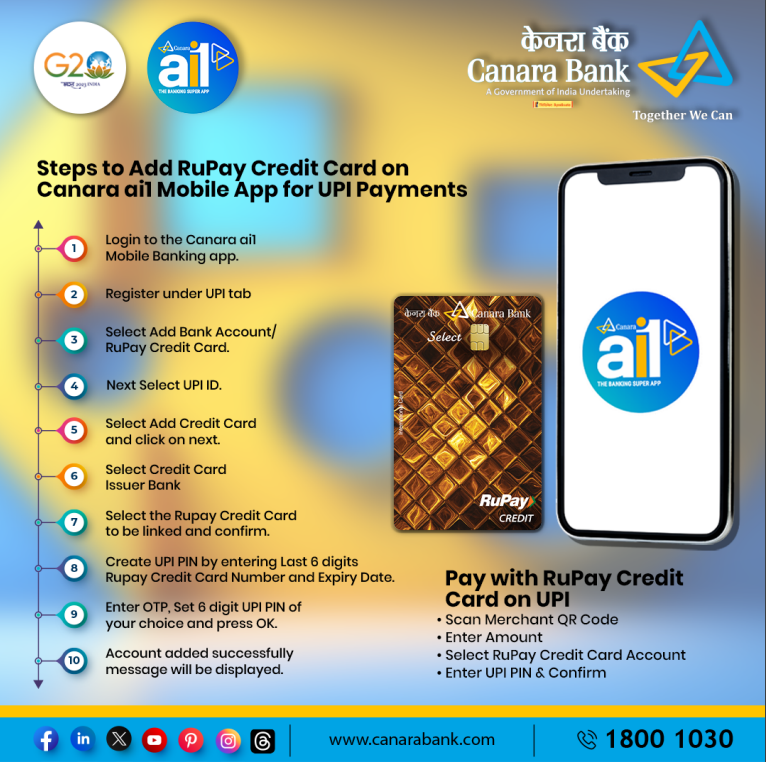

This Credit Card is as similar to existing SBI Prime card with additional customized features and rewards for Reliance stores. This card may be beneficial for those who are purchasing a lot from the reliance stores. Otherwise these features are available with Life Time Free Cards like Canara Rupay Select Credit Card and others.