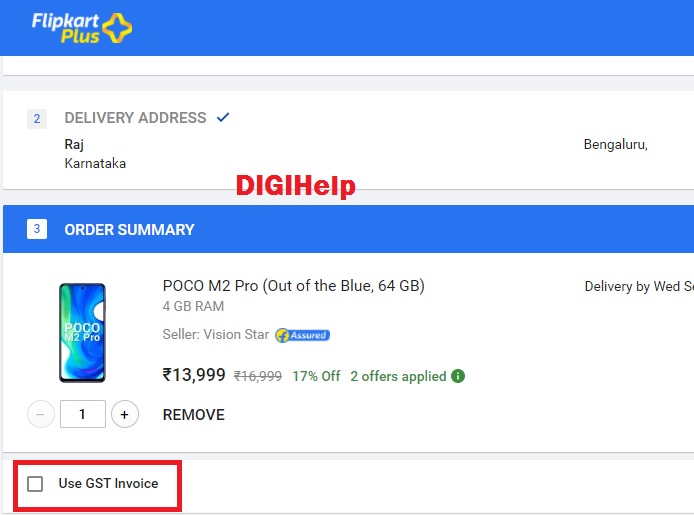

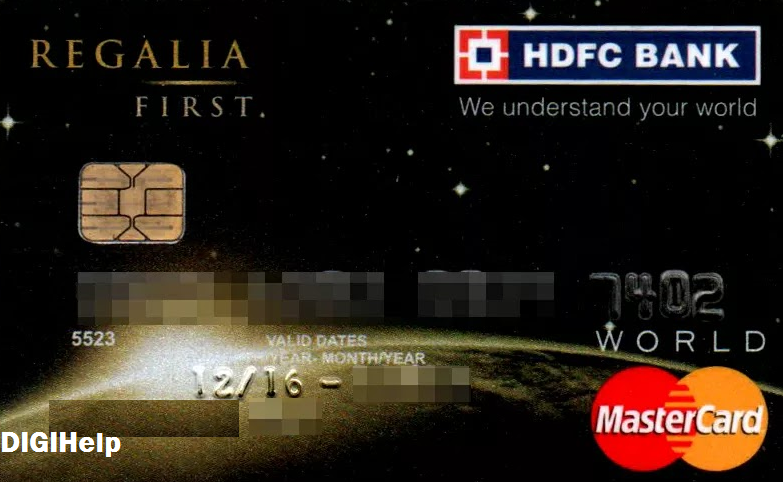

HDFC Bank Regalia First Credit Card Review (2020)

- 5X/10X Accelerated Reward Program

- 5% cashbackte on SmartBuy

- 3 international airport lounge access per year

- 8 domestic airport lounge access per year

- Air Accident Insurance of Rs 50 lacs with no premium

HDFC Bank Regalia Credit Card Review – HDFC is the largest credit card issuer in the India and the most sought credit card of HDFC bank is ‘Regalia First’ Credit Card. The variant of Regalia was initially launched as premium credit card and and not accessible to everyone. Later in order to encash the popularity of the ‘Regalia’ premium, the HDFC had launched the ‘Regalia First’ credit card with few of the premium offering.

In order to downgrade it from the premium to semi premium and for issuance to sub premium category, the card lost many of the features. The devaluation in the features of Regalia First Credit Card is now strengthen with some added benefits in year 2020.

Just check out the benefits of ‘Regalia First’ card in the newest form. Please remember that this is Regalia First and not Regalia Premium Card. Get the Regalia First Credit Card Review from the holder of the card.

Joining Fees & Charges

Key Highlights :

- 1 Joining Fees & Charges

- 2 Reward Points

- 3 Default Reward Rate

- 4 Spend Based Milestones

- 5 5X/10X Offers

- 6 Redemption

- 7 Lounge Access

- 8 Domestic

- 9 International

- 10 Other Benefits

- 11 How to Apply for Regalia First Credit Card

- 12 Option to Regalia First Credit Card

- 13 Bottomline – Regalia First Credit Card Review

- 14 Comparison – HDFC Regalia vs Regalia First Credit Card

- 15 Make it Popular:

| Joining Fee | Rs.1,000 (May be waived OFF) |

| Renewal Fee | Rs. 1,000 |

| Renewal Fee Waiver | Rs. 1 Lakh Annual Spend |

| Variants | (VISA, MasterCard) |

| Maximum Limit | Rs. 5 Lakhs |

NOTE : HDFC is offering Regalia First with free for life (LTF) for customer with high level of credit history. You need to negotiate strongly while applying.

Reward Points

You earn 4 reward points on Rs. 150, on all retail* spends including Insurance, Utilities, Education and RentPay.

Default Reward Rate

- 1 Reward Point = 0.30 INR (when redeemed on regalia portal)

- 4 RP for every 150 INR Retail Spends

- Reward Rate: ~0.80%

Spend Based Milestones

- 8% rewards rate on SmartBuy

- 0.80% rewards rate on general spending

- Get upto 5% cashback on your travel and shopping spends on SmartBuy

- Enjoy a 1% fuel surcharge waiver at all fuel stations across India on transactions between Rs.400 and Rs.5000

* No reward points are earned on fuel transactions

Though the reward rate is not as competitive like other cards in the market like Flipkart Axis Credit Card or SBI Ola Credit Card, which are offering reward rate of 1.5% and 1% respectively. But the facility wise this card is good as it is offering the accelerated reward program with Smartbuy and other merchants.

5X/10X Offers

HDFC runs offers with various merchant to give you 2x/5x/10x of the regular points which multiplies the reward rate so well.

Redemption

For Flight and hotel bookings Regalia First Credit card members can redeem up to maximum of 70% of booking value through Reward Points. Rest will have to be paid via Credit Card. This will be effective from 25.11.2019.

The reward point can also be redeemed against statement credit.

Lounge Access

Domestic

- 8 complimentary access per calendar year within India ( both domestic and international terminal) using Visa / MasterCard Regalia First Credit Card

- Eligible Lounges : Visa Customers Click here / MasterCard customers Click here

Note that most of the Visa and MasterCard lounge limits are set to every quarter, but with Regalia First its an yearly limit, which is great indeed.

International

- Access Via: Priority Pass

- Complimentary Limits: 3 (shared between Primary & Add-on cards)

- Limits Reset: Every Calendar Year

For any query or status of Lounge Access, please write a mail to pp@prioritypass.com.hk. Please provide name, complete 18 digit Priority Pass number and state that PP Membership is via HDFC Bank program. If there is more than 1 Priority Pass number (belonging to add on PP holders), then please provide all the PP Numbers.

Other Benefits

- Foreign Exchange Markup fee: 2% + GST

- Credit Shield: 5 Lakhs

How to Apply for Regalia First Credit Card

HDFC Bank is currently not accepting the new application for Regalia First Credit Card but the eligibility for applying the Credit card as below:

- New Application: >5 Lakh Annual Income (Branch/Online)

- HDFC Preferred Banking: If you’re on Preferred Banking for >6 months with good Balance/AQB, you’ve higher chances to get Regalia if above condition is not met.

- Upgrade: Limits above 3 Lakh on existing HDFC card (Moneyback) with good spends would help.

Option to Regalia First Credit Card

If your request for Regalia First is declined by HDFC, don’t worry, there are similar offering by other banks or if you’re holding Regalia First and looking for some alternative, you may choose any of these cards.

- YesBank Preferred

- SBI Prime

- SBI Elite

- Citibank Premier Miles

- Indusind Iconia

Bottomline – Regalia First Credit Card Review

HDFC Regalia First is though a featured reach card but there are also other alternatives which are equally good. I have been using this card for more than 4 years now and didn’t find it much rewarding if compare with American Express MRCC. It is much popular because of airport lounges as there is no quarterly access limit on this card. Otherwise it is offering only 0.8% reward which is much lower as compare to other cards which are offering more than 1% now.

Comparison – HDFC Regalia vs Regalia First Credit Card

| Regalia | Regalia First | |

|---|---|---|

| Eligibility | Monthly Income > Rs. 1,20,000 | Monthly Income > Rs. 40,000 |

| Annual Fee | Rs. 2,500 | Rs. 1,000, waived off with annual spend of Rs 1 lakhs |

| Welcome Benefit | Zomato Gold Membership | – |

| Reward Rate | 1.3% | 0.8% |

| Spend Based Milestones | 15,000 points on Rs. 8 Lakhs spend | 7,500 points on Rs. 6 Lakhs spend |

| Domestic Airport Lounge Access | 12 | 8 |

| International Airport Lounge Access | 6 | 3 |

| Credit Shield | Rs. 9 Lakhs | Rs. 5 Lakhs |

| Air Accidental Death Coverage | Rs. 1 Crore | Rs. 50 Lakhs |

| Emergency Overseas Hospitalization Coverage | Rs 15 Lakhs | Rs 10 lakhs |