OneCard Review – Life Time Free Credit Card in India

- Life Time Free Credit Card

- Metal Credit Card

- 1% markup Fees on foreign transactions

- Complete Digital issuance

- No documentation

- Higher Credit Limits

- Never expiring Reward Point

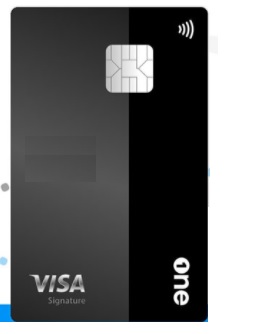

OneCard Credit Card Reviews, a life time free credit card in India with above average benefits and features. The OneCard is an entry level Credit Card with Metal finish launched by FPL Technologies (a new Fintech firm) in association with IDFC bank & Visa (Signature) network. The OneCard looks elegant due to its metal design and overall benefits especially the lower markup fees on Foreign Transactions.

Fees & Charges

Key Highlights :

- 1 Fees & Charges

- 2 Reward Rate

- 3 How to Apply for OneCard Credit Card ?

- 4 OneCard Review – Onboarding Experiences

- 5 Bottomline

- 6 Canara Bank Credit Card Review, Features & Reward Rate

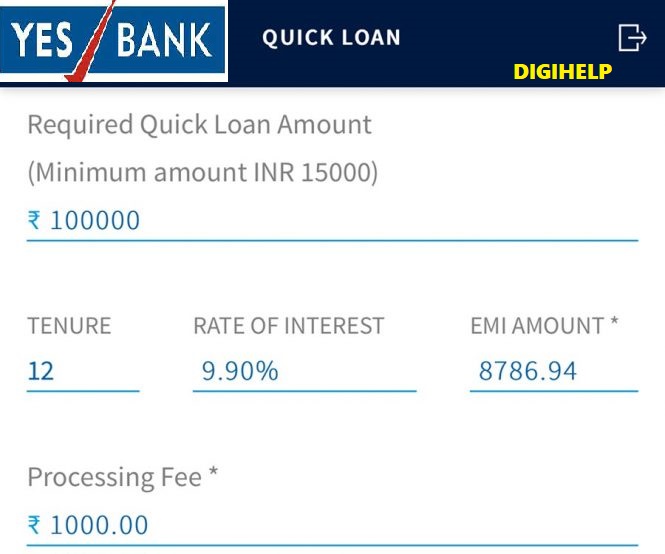

- 7 Yes Bank Credit Card Loan at 9.9%* PA -Cheapest Interest Rate

- 8 Burger King India IPO Reviews

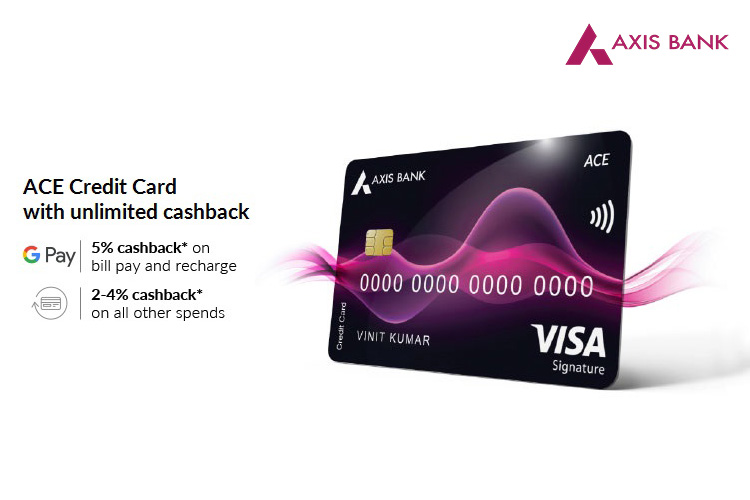

- 9 Google Pay Axis Bank ACE Credit Card Review

- 10 Should I Apply for Canara Bank Credit Card ?

- 11 Canara Bank Credit Card EMI, Interest Rate & Eligibility

- 12 Yes Premia Credit Card Review, EMI Eligibility

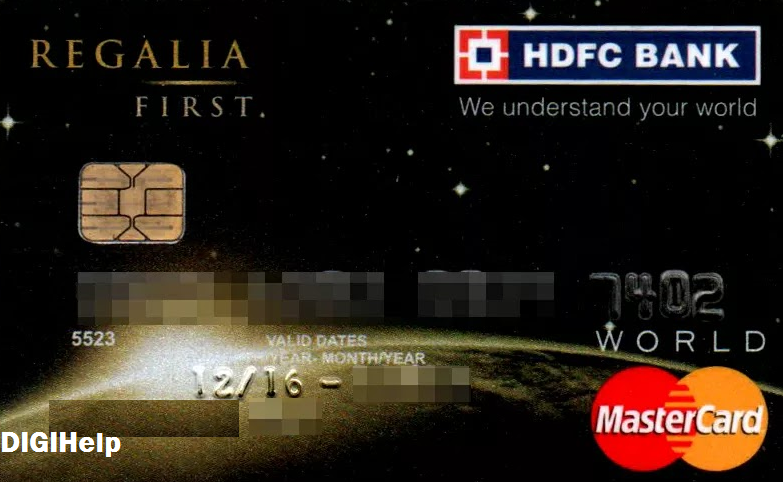

- 13 HDFC Bank Regalia First Credit Card Review (2020)

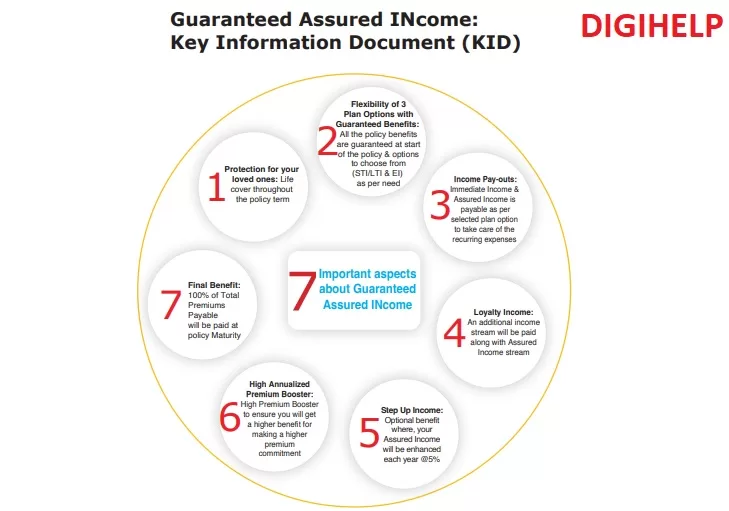

- 14 Canara HSBC Guaranteed Plan Gain Review

- 15 Flipkart Axis Bank Credit Card Reviews

- 16 OneCard Review – Life Time Free Credit Card in IndiaBest Reviewed

- 17 Standard Chartered EaseMyTrip Credit Card Review

- 18 Make it Popular:

The OneCard is free metal Credit Card with No Joining, No Annual Fees. The OneCard is offering the Foreign Transaction Markup fees of 1% which is lowest in Life Time Free (LTF) category of the Credit Cards offered by any banks in India. If you are doing frequent foreign transactions, this card is best suited for you. The overall Fees & charges on this card :

| Joining Fee | Nil |

| Annual Fee | Nil |

| Markup Fee | 1%+GST |

| Interest Rate | 2.5% |

Reward Rate

If you compare the OneCard with other Life Time Free Credit Card, you will find the reward rate offered by it much rewarding. The overall average reward rate is approximately 1%, which is better than Citibank Reward card or SBI OLA Credit Card.

| Normal Reward Rate | 1 RP= Rs.50 |

| Accelerated Rewards Point | 5X RP on top 2 categories |

| Reward Value | 10 Ps to Rs.1 |

| Regular Reward Rate | 0.2% to 2% |

| Accelerated Reward rate | 1% to 10% |

As like American Express Membership Reward Credit Card (MRCC), you can redeem the reward point against the statement credit. The reward point never expires. No reward point on loading the Wallet or transfer through Amazon Pay. Recently almost all the popular credit cards except MRCC are not rewarding on wallet loading.

Also Read – HDFC Regalia Credit Card Foreign Currency Markup Fee

How to Apply for OneCard Credit Card ?

The application process for OneCard is completely on invitation basis and not available offline. The entire process for issuance of the credit card is online. Applicants have to install OneScore android application that gives you free credit score of CBIL or Experian through App. Within the app they have an option to show interest for the OneCard. You get into waitlist and you will be informed when its available.

OneCard is currently available in 15 cities including Pune, Mumbai, Bangalore, Ahmedabad, Baroda, Surat & Delhi. Other cities maybe added soon.

OneCard Review – Onboarding Experiences

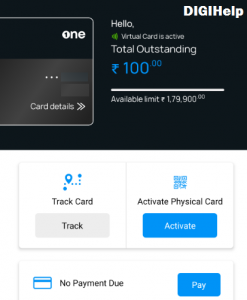

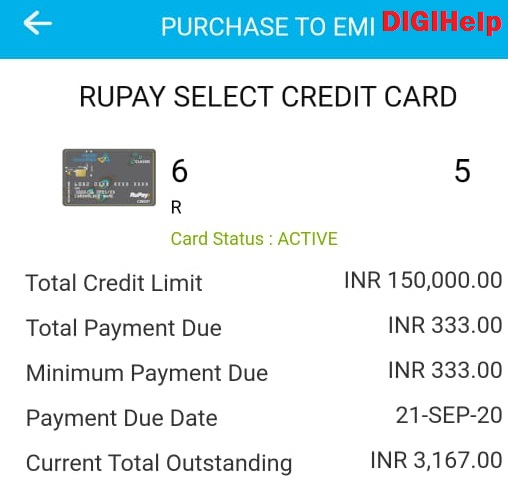

The onboarding process for Credit Card is completely digital with no physical verification or asked for documents. The first credit card which is issued purely on your CIBIL score. In my case the Credit Card was issued to me within 15 days without any heist. Initially while applying it was showing a very high waiting list, suddenly within 20 days, I got notification on my app that my OneCard credit Card with credit limit of Rs 1,80,000 approved. Though my CIBIL score is more than 760.

Once getting the approval of Limit, you need to install the OneCard mobile application and digital card will be activated for online transactions. Physical card will be delivered after a week and status will be available on the application itself.

As far as my experience, the complete process is smooth and hassle free. Click to Apply for this Card.

Bottomline

Overall the experience of OneCard is satisfactory and will recommend for first time users. A life time free card with considerably good reward rate with accelerated points. In near future, this card will surely give the best returns on the transactions and value of money.

Pointless to use this card.

Good day, everyone! Three months have passed since I last used this card; it is now utterly useless. I made a deposit of approximately 5,000 thousand INR to initiate the account and have been issued a credit limit equivalent to that amount. It seems to be a debit card. In addition, there were numerous fees, which implies I am required to pay additionally approximately 1,500 rupees per month. Having now terminated the account with cancellation charge around 958 INR, I am having difficulty retrieving my deposit and they stated a lot lies and difficulties. I am happy to get in touch with RBI effective customer grievance redressal on this matter and i will. The service is completely pointless, and the customer service messaging system is a joke.

OneCard has revised the rate of interest to 3% per month.

Easy to get the Credit Card by OneCard. No documentation completely digital. Awesome !!!