How to Get Cash from Credit Card Without Charges ? Know the best Credit Card with lowest charges and fees to fund transfer or cash withdrawal from the bank account. There are many ways to transfer the credit card balance in to the bank account but none of them are free. There are charges involves with the transfer of funds and that lies within the range of 2.50% to 5%. This also depends on the Card issuers like in case of American Express Credit Card, the charges for transfer of funds to bank account through wallets like Paytm is higher than other cards and it comes aroung 5%.

While you may have the advantage of making big purchases on goods and services such as household items or that hi-end television set that you have been eying for months using your credit card, you cannot pay your home loans or your auto loans using the card. This is also the case if you have a high credit card bull. In cases like this, transferring funds from your credit card to your bank account becomes a viable option. This way, you can pay your home loans and car loans directly from your bank account.

This method is useful in times of emergency e.g. in case you are abroad, and the family is in India. You can basically transfer money from your credit card to a family member’s bank account. This method is also useful in case you are in an area where there is limited or no access to an ATM or a bank.

However, in case you plan on transferring funds from your credit card to your bank account, you may want to consider the following points.

Consider the commission/charges: Remember that if you transfer funds from your credit card to your bank account, you will be charged a certain flat charges.

Pay a fee: In case you transfer funds from your credit card to your bank account, you will be charged a fee. The rate of fee depends on your card provider but is usually 3-4 per cent.

Charges for Transfer of Funds from Credit Cards

Key Highlights :

- Payzapp – usually, payzapp charges flat 2.5% with limit up to Rs 1,00,000 in a month for verified customers. Do remember that at once you can only transfer maximum of Rs 25000. It also restricts the number of credit cards listed for adding the funds to maximum three.

- Mobikwik – It usually charges 3.15% flat commission on fund transfer. The maximum limit for a month is Rs 1,00,000 for KYC verified customers. You can add as many as credit card you like for adding the money to the wallets.

- Paytm – highest among the peers. It usually charges 5% . The rate is higher as there are charges for adding fund to the wallet, where as its free with other eWallets.

We recommend through these wallets as they are reliable and tested. There are many crdit card which are not rewarding the cash load to the wallets like SBI, OneCard etc. Additionally there are many credit cards like OneCard which is not allowing to convert the transaction for adding cash to wallet for EMI conversion.

How do I transfer funds from my credit card to my bank account?

There are a few ways in which you can transfer funds from your credit card to your bank account. These include:

– Through e-wallets like Paytm, Payzapp, Mobikwik etc.

– Through tools such as Western Union and/or MoneyGram

Let us look at the following

Through e-wallets

Wire transfers are the most popular way to transfer funds from your credit card to you bank account. These transactions are scrutinized by the government and need to adhere to regulatory guidelines and requirements. Among the list of details, you would require to provide are currency of transfer, international bank account number, the name of the correspondent, and the SWIFT code.

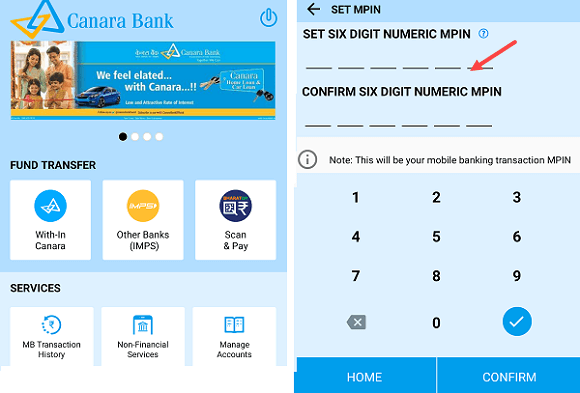

You can use tools such as PayZapp and Paytm – each of which has its own regular set of guidelines to conduct the transactions. These include the amount you can transfer, the fees that will be levied on you, and the time period when you can conduct such transfers,

Through tools like Western Union or MoneyGram

When you use money transfer companies, you have the option of sending money across the globe, but you have to provide all your details with the firm. It usually takes 1-5 day to transfer money from your credit card to your account.