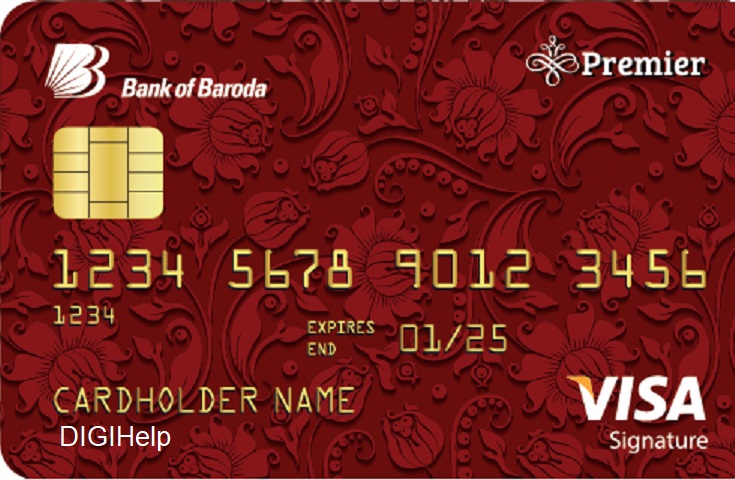

Bank of Baroda Premier Credit Card Reviews

- Zero lost card liability post reporting

- Personal Accident insurance coverage

- 50% discount on VISA Golf Offers

Bank of Baroda Premier Credit Card Reviews – Bank of Baroda is offering the Premier Credit Card to premium customers with 5X reward on travel, dining and foreign transactions. Additionally the Premier credit card is also offering the complimentary access to domestic lounges and free insurance coverage for accidental death.

BoB financial, the card division arm of Bank of Baroda is the late entrant to the credit card business but promoting their card business with lot of discounts and offers on foods, grocery and travels.

Joining Fees & Charges

Key Highlights :

- 1 Joining Fees & Charges

- 2 Reward Points

- 3 Default Reward Rate

- 4 Spend Based Milestones

- 5 5X/10X Reward Offers

- 6 Redemption

- 7 Lounge Access

- 8 Domestic

- 9 International

- 10 Other Benefits

- 11 How to Apply for Bank of Baroda Premier Credit Card

- 12 Bottomline – Bank of Baroda Premier Credit Card Reviews

- 13 Personal Experiences of Premier Credit Card

- 14 Make it Popular:

| Joining Fee |

Rs.1,000 Spend Rs. 10,000 on your card within 60 days for fee reversal Fee reversal will reflect in the 4th bill statement from the card issuance month, provided all due payments are made |

| Renewal Fee | Rs. 1,000 |

| Renewal Fee Waiver | Rs. 1.20 Lakhs Annual Spend |

| Variants | VISA |

| Maximum Limit | No Cap |

Reward Points

You earn 2 reward points on Rs. 100, on all retail* spends including Insurance, Utilities, Education and RentPay.

Default Reward Rate

- 1 Reward Point = 0.25 INR

- 2 RP for every 100 INR Retail Spends

- Reward Rate: ~ 0.50%

Spend Based Milestones

- Enjoy a 1% fuel surcharge waiver at all fuel stations across India on transactions between Rs.400 and Rs.5000

- 5X reward point on International spend

Though the reward rate is not as competitive like other cards in the market like Flipkart Axis Credit Card or SBI Ola Credit Card or even Ragila First Credit Card, which are offering reward rate of 1.5%, 1% and 0.80% respectively.

5X/10X Reward Offers

Earn 2 Reward Points for every Rs 100 spent across all categories. Accelerate your rewards 10 times when you use the card for Online Travel Aggregators, Dining, and International spend with a maximum of 2000 points.

Also Read – HDFC Bank Indigo Ka-Ching 6E Rewards Credit Card Reviews

Redemption

The reward point can be redeemed against statement credit.

Lounge Access

Domestic

- 4 complimentary lounge access per calendar year within India

International

No International Airport Lounge access.

This is really starnge as Premier Credit Card is the premium offering by Bank of Baroda without International Airport lounge access. If compare with the higher fees of the card, the absence of this facility is really strange.

Other Benefits

- Zero lost card liability post reporting

- Personal Accident insurance coverage

- 50% discount on VISA Golf Offers

How to Apply for Bank of Baroda Premier Credit Card

Applying to bank of baroda for Premier Cfredit Card is very easy. Just visit the bank of baroda Internet Banking or Mobile Banking or website and provide your details with mobile number. You may get a call from their customer care for confirmation of details. (Not sure after how many days, in my case it was after 5 days)

There is no specific income criteria is defined by the bank for issuance of the credit card. The limit is fixed based on the credit scores.

Bottomline – Bank of Baroda Premier Credit Card Reviews

Bank of Baroda Premier Credit Card is having a higher issuance charges as compare to features and benefits it offers. The annual fees of the Card is Rs 1000 which doesn’t justify the features and reward rate offering. In my view, the bank of baroda has to improve a lot to make themselves competitive in the business. I suggest to go with SBI or CitiBank credit cards which has a very low annual fees but higher benefits and offering as compare to Bank of Baroda primer Credit Card.

| Fee Type | Amount |

|---|---|

| First-year fee | Rs.1,000 |

| Annual fee | Rs.1,000 |

| Cash withdrawal fee (Domestic ATMs) | 2.5% of the transaction amount subject to a minimum of Rs.300 |

| Cash withdrawal fee (International ATMs) | 3.0% of the transaction amount subject to a minimum of Rs.300 |

| Finance charges or interest | 3.25% per month or 39% per annum |

| Duplicate bill fee | Rs.25 per request |

| Cheque return charges | 2% of the cheque amount or Rs.300 whichever is higher |

| Over limit charges | 1% if the usage exceeds the sanctioned credit limit per month |

| Card replacement charges | Rs.100 per request |

| Foreign currency transaction fee | 3.5% of the transaction amount |

| Charge slip retrieval charges | Rs.250 per slip |

| Card de-blocking charges | Rs.300 per instance |

| Late payment charges | If the outstanding is

|

Personal Experiences of Premier Credit Card

I had recently applied for the premier credit card by BoB and recived after a week. I must say that they are damn good in approving the credit card and if you are an existing credit card holder of any banks with CIBIL score of more than 700, there are higher chances of getting the approval by Bank of Baroda.

Interestingly while collecting the application, they even don’t bother to take the consent for the type of credit cards. In my case I was not asked about any variant of the Credit Card and surprisingly I get the Primer Card which I never wanted to be.