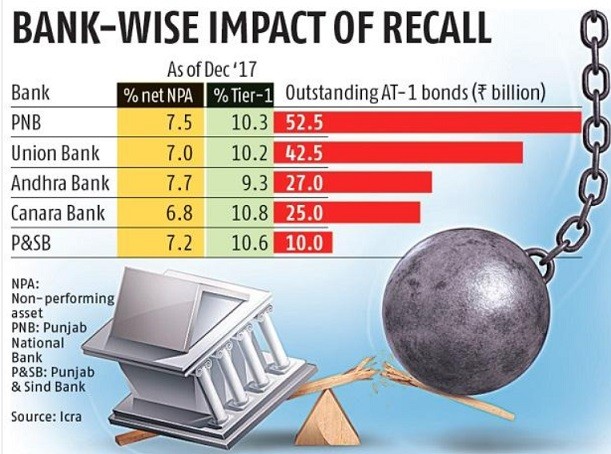

Reports from rating agency ICRA stated that Five Public Sector Bank’s Canara Bank, Punjab National Bank, Union Bank of India, Andhra Bank and Punjab & Sind bank may put under Prompt Corrective Action Plan (PCA) due to recall of Rs 157-bn AT-1 bonds. These five public sector banks as per Rating agency ICRA ,their net non-performing assets (NPAs) rose above 6 per cent in December 2017. As per the requirement of RBI to put under NPA minimum requirements of CAR or net NPAs rise above 6 per cent or the RoA is negative for two years.

What is AT-1 Bonds ?

AT-1 bonds are no maturity date bond but continue to pay the coupon forever. AT-1 issuer banks has the option to call back the bonds or repay the principal after a specified period of time.

Major highlights of ICRA analysis

- Public sector banks have raised total of Rs 603.85 billion in the last four years, majorly through AT-1 bonds and achieved their Tier-1 capital ratios.

- Many of these PSB’s raised AT-1 bond despite of losses, increasing capital requirements under Basel-III, and limited capital infusion by the government in relation to their requirements.

- The Capital ratios of these banks may reduce by 0.7-2.0 per cent of risk weighted assets.