Know the steps to complaint against Unauthorized Digital Loan Apps, which are claiming to provide instant loan through mobile application are now at the eye storm. The Reserve Bank of India (RBI) has cautioned users against unauthorized digital lending platforms and mobile applications that promise quick loans. RBI has called it as Scam to fool people. All these has come due to some harassment made by these digital apps in Hyderabad and other parts of the country.

RBI has issued statement and said that

“Legitimate public lending activities can be undertaken by banks, non-banking financial companies (NBFCs) registered with the RBI and other entities who are regulated by state governments under statutory provisions, such as the money lending acts of the concerned states”.

How Digital Loan Apps are Death Traps for Borrowers ?

Key Highlights :

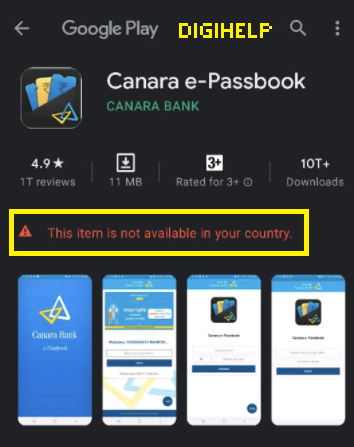

There are a list of Instant Loan Apps are available on Google Playstore to Download like Hey Fish, Monkey Cash, Cash Elephant, Loan Zone, Cash Zone, Water Elephant, and Mera Loan etc. These apps are offering small loans and collecting money by harassing and blackmailing the victims. Several people have fallen into their trap and been cheated.

- These Loan Apps are offering small loans with Daily EMI option for shorter period like 7 days, 20 days or 30 days.

- The rate of interest and other charges are very high like more than 40%

- For a loan of Rs 30000, the processing and other charge are Rs 10000

- Generally, individuals and small businesses falling prey to such digital platforms that charge high rates of interest or demand additional hidden charges from borrowers.

The RBI has strongly advised against sharing KYC documents with unidentified persons or unauthorized apps as mentioned above . If any person comes across an unverified or unauthorized digital lending platform they must inform the concerned law enforcement authorities about it.

Also Read – How Can Investors Register Complaint using SEBI Scores ?

They may also raise complaint to the following portals :

- Visit the Sachet portal and register a complaint online.

- Visit visit the RBI portal to check the list of NBFCs registered with the regulator.

- File complaints against the entities regulated by the RBI – visit https://cms.rbi.org.in.

NOTE : The RBI has made it mandatory for all digital lending platforms used by RBI-registered banks and NBFCs to disclose the names of the bank and NBFC directly to the consumers.