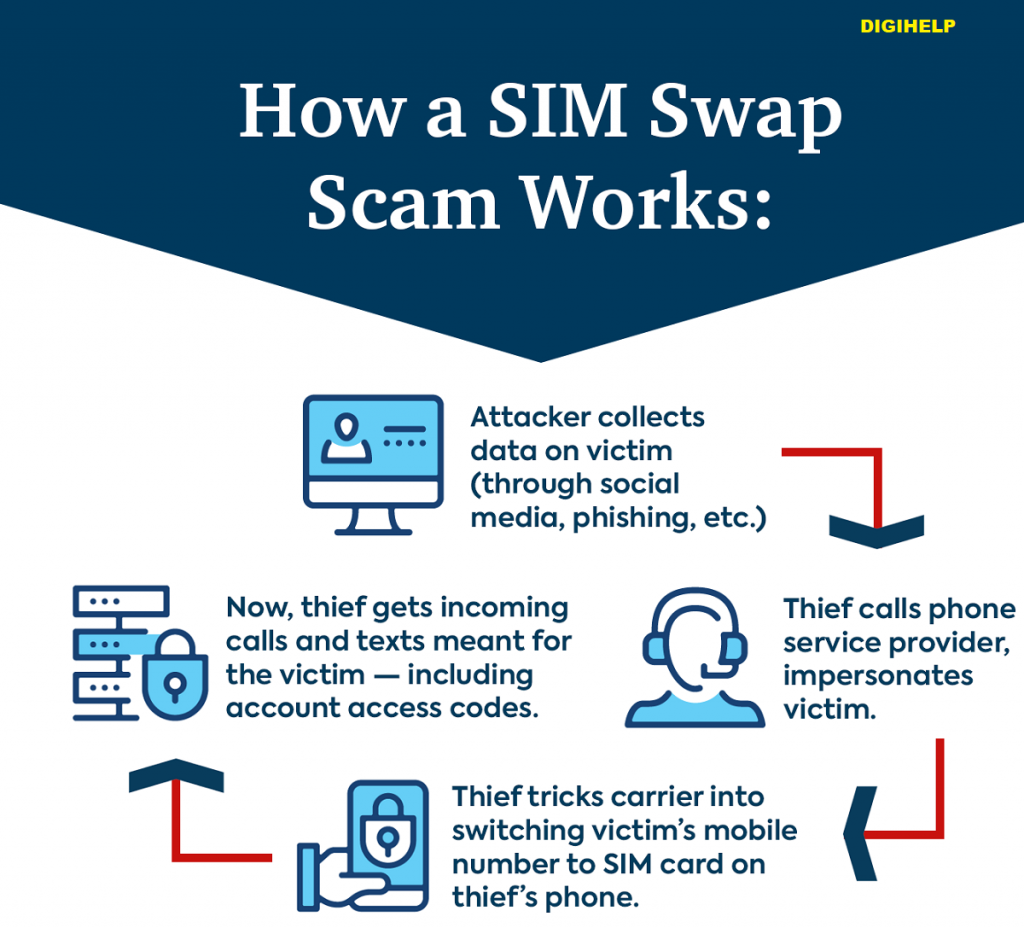

Know the steps to Protect From Missed Call & SIM Swap Bank Fraud, which is at peak now a days. Innocent people are robbed by millions through this new technique of Missed Call fraud through SIM Swap. A SIM swap scam is a type of account takeover fraud that misuses personal information in getting duplicate SIM and committing frauds by getting OTP in fraudsters ‘s mobile device.

What is SIM Swap Scam ?

Key Highlights :

- 1 What is SIM Swap Scam ?

- 2 How the Missed Call fraud happens?

- 3 On phone, it all starts with an unknown call claimed to be from telecom service providers like Jio, Airtel, Vodafone. BSNL etc.

- 4 Asking for the 20-digit SIM number

- 5 You may be asked to press some keypad number like 1 or 2 etc. to authenticate the SIM Swap

- 6 Your Mobile Network will Go instantly on SIM Swap

- 7 Never off or mute your phone to ignore anonymous calls

- 8 Never share Aadhaar Number

- 9 How to protect from SIM Swap Bank Fraud?

- 10 How did the victim lose money after his SIM card got hacked?

- 11 Make it Popular:

SIM Swap or simply SIM card exchange is basically registering a new SIM card with your phone number. Once it is done, your SIM card will become invalid and your phone will stop receiving signal. Now, once the miscreants have your phone number, they will get OTPs on their SIM card. With this they can initiate bank transfer and even opt to shop online after getting OTPs.

How the Missed Call fraud happens?

-

On phone, it all starts with an unknown call claimed to be from telecom service providers like Jio, Airtel, Vodafone. BSNL etc.

You will get a call from a person who will pose as a customer care executive from the telecom service providers like Airtel or Vodafone or Jio or Idea. They may ask you to upgrade the SIM card for easy access or higher Internet speed etc or to migrate to a 5G SIM card.

-

Asking for the 20-digit SIM number

The entire conversation will be made to get your unique 20-digit SIM number. Every SIM card has this 20-digit number and the scamster will try to convince you share your 20-digit unique number.

-

You may be asked to press some keypad number like 1 or 2 etc. to authenticate the SIM Swap

After convincing you to send the unique SIM number, the scamster will tell you to press 1, 2 or simply authenticate the SIM swap. Once you press the desire number, the unique SIM number will initiate the ‘Swap’ with your telecom operator officially. For example, if you have an Airtel SIM, the scamster will use a new Airtel SIM to officially process the exchange of SIM card. Now, Airtel will send a confirmation SMS to your phone number and the scamster would want you to press 1 or 2 to authenticate the SIM Swap. With this, Airtel will understand that you have officially initiated the SIM Swap but then the attacker will end up hijacking your phone number.

-

Your Mobile Network will Go instantly on SIM Swap

Once the sim swap is successful, your SIM card will stop working and you will not get any signal on your phone. Where as the fraudster new SIM card will get full signal with your mobile number. The fraudster will have total control over mobile number.

-

Never off or mute your phone to ignore anonymous calls

In most cases, fraudster will irritate to get the phone switched off or mute. This is crucial to buy time for scamsters. Usually, telecom operators take around four hours to activate a new SIM. So, the scamster will continuously call you and disturb you so that you either switch off phone or silent it during this 4-hour window. Now, when the Swap is complete you will not even get to know about it.

-

Just imagine the possibilities of fraud if the scamsters have got access to your phone number as well as Aadhaar number. These days most services can be accessed using both these together and once your Aadhaar number and phone number is available, it can lead to serious identity theft.

Also Know – How to Protect Your Credit Card Online ?

How to protect from SIM Swap Bank Fraud?

- Beware of phishing emails and other social engineering attacks which try to access personal information.

- Change in mobile numbers and E-mail ids should be updated in Bank’s account by visiting the branch immediately.

- Keep checking the SMS / E-mail alerts received from the Bank.

- SIM Swap can only be done by knowing the unique 20-digit SIM number printed on every SIM card

- Every SIM card has this 20-digit number. Look for it at the back of your SIM card.

- In a fraud case, either the scamster will try to convince you share your 20-digit unique number or they have already hacked it to get it.

- Keep a tab on your bank balance regularly

How did the victim lose money after his SIM card got hacked?

It is basically a two-step process including SIM Swap. The scamster, in most cases, already has information about your banking ID and password. All they need is the OTP that you get on your registered mobile number to make financial transactions.