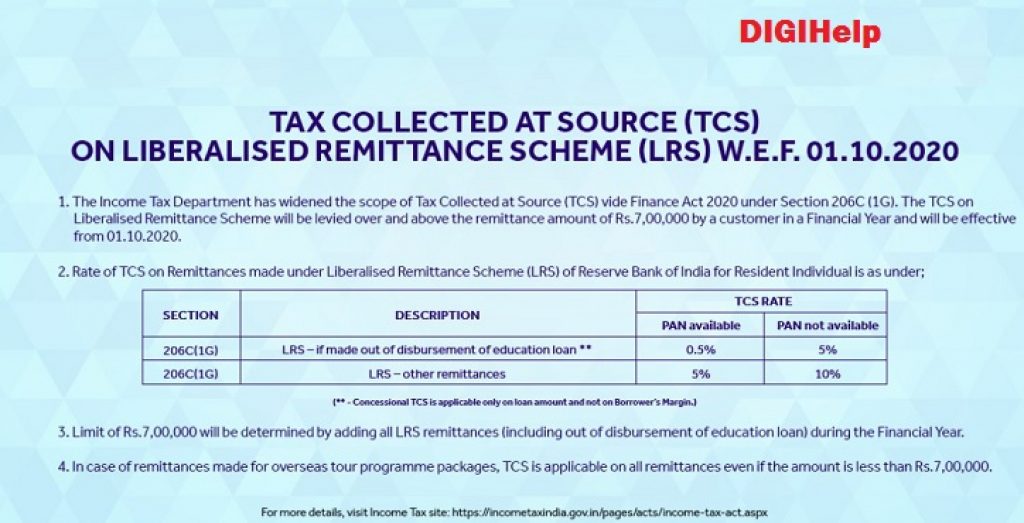

TCS Rate on Foreign Remittance & its Calculation – A Tax Collection at Source (TCS) of 5% was implemented from October 1st. This rate is for foreign tour packages; for, other foreign remittances including education loan, it will apply only for an amount exceeding Rs 7 lakh. However, in case of education-related foreign remittances funded by loans, a TCS of 0.5% will be levied for an amount above Rs 7 lakh.

Know TCS Rate on Foreign Remittance:

Key Highlights :

• While the rate of TCS is 5%, it will be 10% in case PAN or Aadhaar is not provided to an Authorised Dealer of the foreign exchange in question. In case of foreign travel, the TCS is collected by the travel operator.

• The TCS will not be applicable if you make all arrangements of foreign tour on your own. It will also not apply if the remitter is subject to the TDS, under the Income Tax Act, 1961.

• If tax has already been paid as TDS, and still the TCS is levied, you can claim a refund from the TCS.

How will 5% TCS be calculated?

The 5% tax is collected at source only on the amount above 7 lakh. For example, if you remit ₹10 lakh in a year, 5% will be calculated on 3 lakh i.e. ₹15,000 will be deducted as TCS.

How will 5% TCS be calculated for the current financial year?

For the current financial year, any remittances made post March 2020 will count towards the 7 lakh threshold.

For Example : If you have transferred ₹6 lakh before October and you transfer additional ₹5 lakh after October this year, then the 5% TCS will be calculated on ₹11 lakh – Rs7 lakh = ₹4 lakh. So, 5% of 4 lakh which is ₹20,000 will be debited as TCS.”

NOTE : But if you have already made remittances more than ₹7 lakh before October 2020, no TCS is payable.

Also Read – Know the Income Tax New Policy,Rules and Changes by CBDT

How much TCS Rate on Foreign Remittance on foreign tour packages?

Payments for foreign tour packages are also subject to the 5% TCS without any exemption threshold. There will be no TCS if you book a foreign tour yourself instead of going through a travel agency.

How much tax will be collected on remittance for an Education Loan purpose?

If educational expense is financed through a loan, a TCS of 0.5% on transfer amount above the threshold of ₹7 lakh will be deducted.

If educational expenses is not financed through a loan, 5% tax on amount transferred amount above the threshold of ₹7 lakh will be deducted. Check Income Tax TCS Rate.