How To Make Correction in PAN Card ? – Many a time viewers has raised the question whether they would be able to change the details of PAN or not especially in case of women viewers as they face problem while doing transaction with banks or other financial institution as their name get changed after marriage.

Many a time they start thinking about the issuing of duplicate PAN card instead of updating their details through NSDL. Updating or changing the details of PAN card is very much easy. Just Follow the below mentioned steps in order to make correction in PAN card (Permanent Account Number)

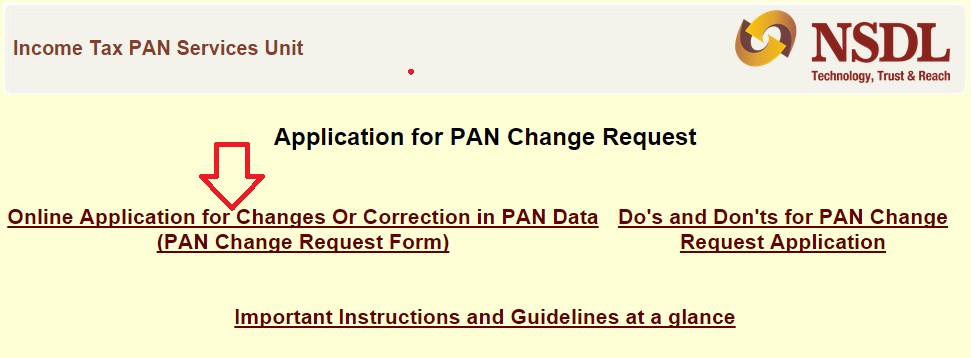

1. Just visit the NSDL website for Instruction Here

2. Apply Online the Correction change

3. In case of either a request for Change or Correction in PAN data or request for re-issuance of a PAN Card without any changes in PAN data, the address for communication will be updated in the ITD database using address for communication provided in the application.

4. The fee for processing PAN application is ![]() 107.00 (

107.00 ( ![]() 93.00 + 14% service tax). Fees can be paid online through NET Banking.

93.00 + 14% service tax). Fees can be paid online through NET Banking.

Read :How To Apply For New PAN card ?

On successful credit card / debit card / net banking payment, acknowledgement will be displayed. Applicant shall save and print the acknowledgement and send it to NSDL as mentioned in point ‘IV – Mode of Submission of Documents’ below.To check status of online payment or to regenerate Acknowledgment receipt, please click here and fill details accordingly.

The acknowledgement duly signed, affixed with photograph (in case of ‘Individuals’) alongwith demand draft, if any, proof of existing PAN, proof of identity, address & date of birth(applicable for Individual & Karta of HUF) as specified in the application along with any other relevant proof as specified (in Item No.IV – Documents to be submitted along with the application ) is to be sent to NSDL at ‘NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016′.

Super scribe the envelope with ‘APPLICATION FOR PAN CHANGE REQUEST— N-Acknowledgment Number’ (e.g. ‘APPLICATION FOR PAN CHANGE REQUEST— N-881010200000097’).

Your acknowledgement, demand draft, if any, and proofs, should reach NSDL within 15 days from the date of online application.

| For more information | |

| – | Call PAN/TDS Call Centre at 020 – 27218080 |

| – | Fax: 020-27218081 |

| – | e-mail us at: tininfo@nsdl.co.in |

| – | SMS NSDLPAN <space> Acknowledgement No. & send to 57575 to obtain application status. |

| – | Write to: INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance Infrastructure Limited), 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016 |