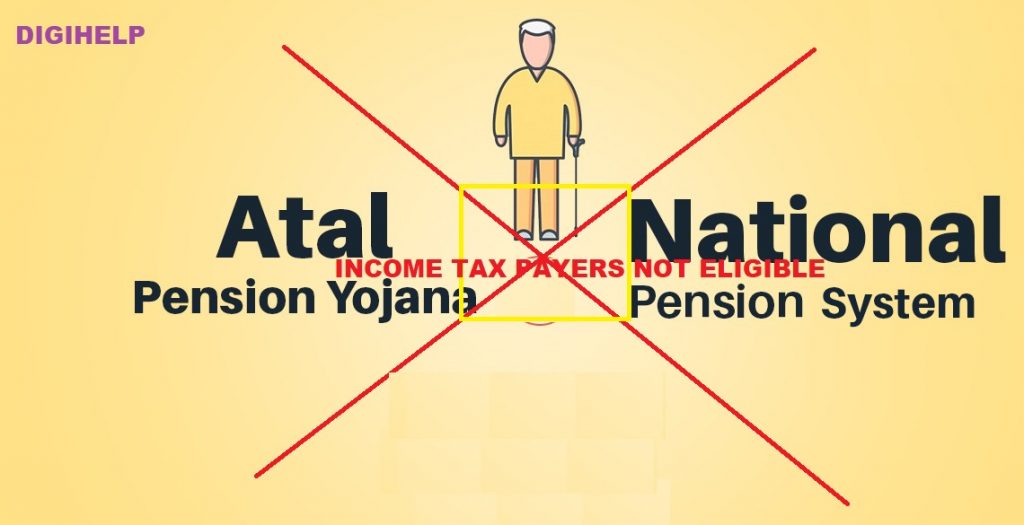

Income Tax Payers Are Not Eligible for enrolling under Atal Pension Yojana (APY). PFRDA has amend the existing pension law to implement it from October, 1st. The APY scheme was launched by Government of India on June 1, 2015, to provide social security to workers mainly in the unorganized sector. As per notification released, the Income tax payers will not be allowed to enroll in the government’s social security scheme Atal Pension Yojana (APY) from October 1.

Subscribers of the APY scheme get a minimum guaranteed pension of ₹1,000 to ₹5,000 per month after attaining 60 years of age depending on their contributions. Currently, any individual between the age group of 18-40 years can join APY through any scheduled banks or post office branches where one has the savings bank account.

Also Know – How to Open Atal Pension Yojana (APY) Account Online ?

The ministry has modified its earlier notification on APY. The new notification, issued will not apply to subscribers who have joined or joins the scheme before October 1, 2022.

If any of the APY subscribers who joined on or after October 1, 2022, is subsequently found to have been an income tax payer on or before the date of application, the APY account shall be closed and the accumulated pension wealth till date would be given to the subscriber. As per Income Tax rules, an individual with income up to ₹2.5 lakh are not required to pay income tax.

90+ lakhs of APY accounts were opened during the last fiscal, taking the total number of subscribers to 4.01 crore at the end of March 2022.