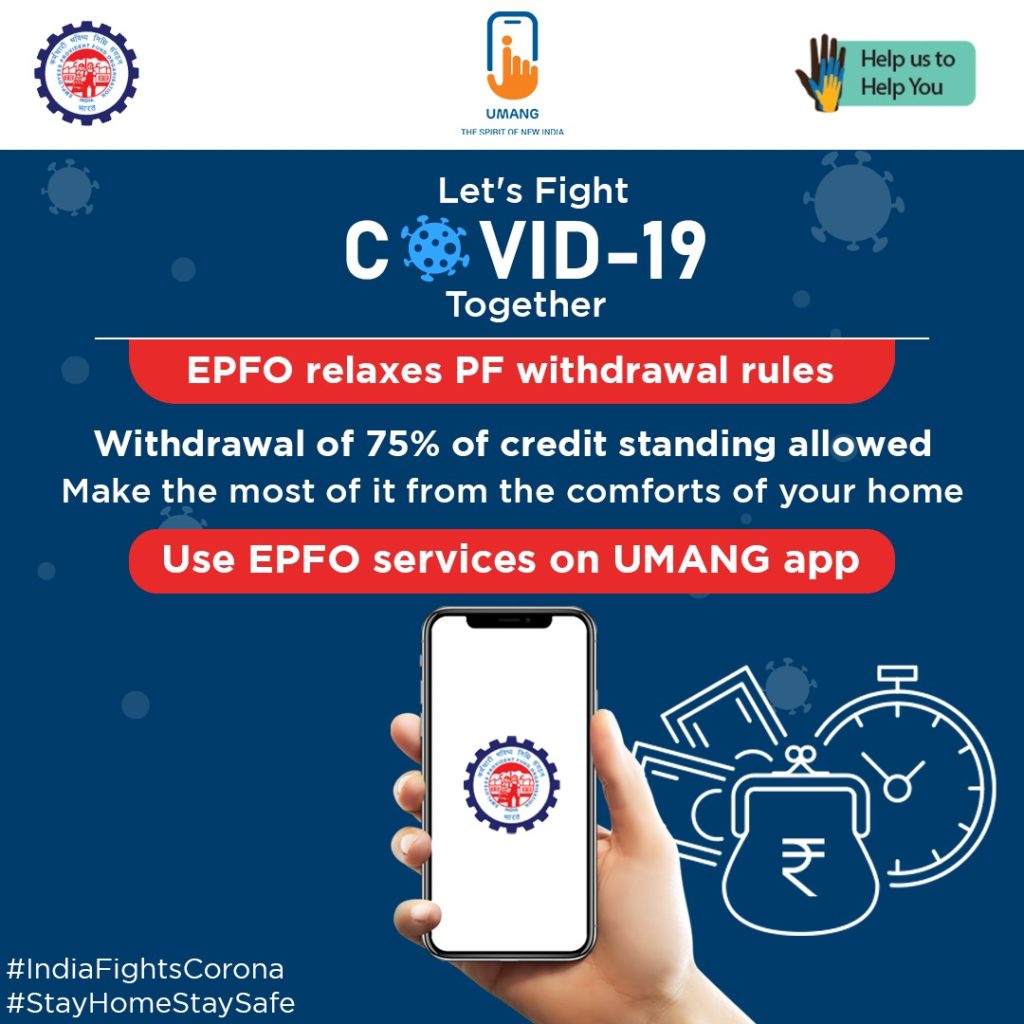

EPF withdrawal, If you are running out of money and needs the fund urgently without any loan then you can withdraw from Provident Fund account. The EPF withdrawal is exclusive for COVID-19 and allowed with certain conditions. Check out the rules, process and other criteria for withdrawing money from EPF account.

EPF Withdrawal – Process to withdraw money from EPF account:

Key Highlights :

For e.g. – You have Rs 1 lakh in PF account and your monthly Basic+Da is Rs 20,000.

The 75% of Rs 1 lakh is Rs 0.75 lakh, while the three months of Basic and DA will be Rs 20,000×3 = Rs 60,000. Hence, in this case, you will be able to withdraw maximum Rs 60,000 from your EPF account.

NOTE : Under any circumstances, you can’t withdraw more than 75% of the outstanding EPF amount even if Basic+DA is higher.

EPF Withdrawal – How to claim PF advance ?

a. Login to Member Interface of Unified Portal here

b. Go to Online Services>>Claim (Form-31,19,10C & 10D)

c. Enter your Bank Account and click verify

d. Click on “Proceed for Online Claim”

e. Select PF Advance (Form 31) from the drop down

f. Select purpose as “Outbreak of pandemic (COVID-19)” from the drop down

g. Enter amount required and Upload scanned copy of cheque and enter your address

h. Click on “Get Aadhaar OTP”

i. Enter the OTP received on Aadhaar linked mobile.

j. Claim is submitted.

EPF Withdrawal – who can withdraw/eligibility ?

The eligibility of EPF withdrawal :

1. You can withdraw maximum of 75% of the outstanding EPF amount, or three months of Basic+DA, whichever is lower.

2. The withdrawal application can be made online through EPFO portal.

3. The application for COVID-19 claim is allowed even if any other advance is pending.

4. PF advance for COVID-19 can be claimed only once.