Canara hsbc guaranteed plan Gain review, features & Key Benefits – Canara HSBC insurance company has launched a guaranteed saving plan called it GAIN for assured income at the end of the policy year. This policy my be beneficial for those who are having some set goals to achieve in the regular interval of lifetime like Kids education, daughter marriage etc. The term insurance will be 11 times of the premium.

The GAIN plan is having option to get the fixed income after end of premium payment years of 6 years. The guaranteed income may be taken for further 4 years with full premium reimbursement at the end of the policy year. The Income received each year is tax free.

Also Read – Apply Canara Bank Health Insurance Policy With Bajaj Allianz

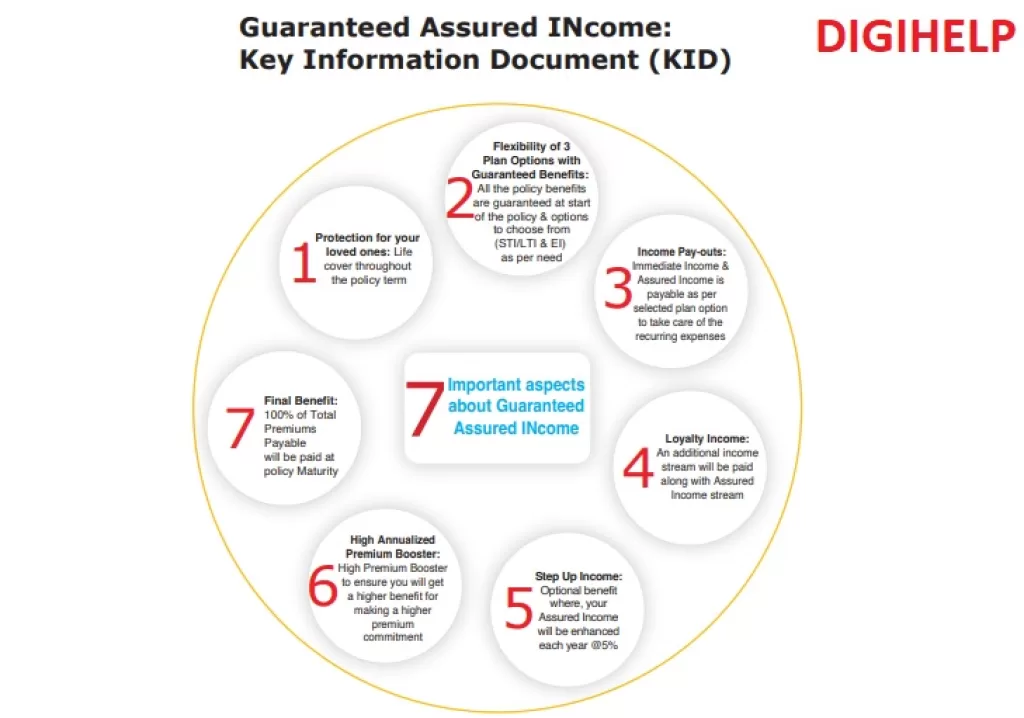

Key Benefits

Key Highlights :

- Income Pay-outs: An Assured Income starts post completion of Premium Payment Term & Deferment Period to take care of the recurring expenses

- Step Up Income: Optional benefit where, your Assured Income will be enhanced each year @5% p.a

- Loyalty Income: An additional income stream will be paid along with Assured Income stream

- Tax Benefits: As per applicable laws as amended from time to time

- Final Benefit: 100% of Total Premiums payable will be paid at Policy Maturity

Surrender of Policy

On surrender of the policy, the Surrender Value payable will be higher of Guaranteed Surrender Value (GSV) or Special Surrender Value (SSV). A limited premium pay policy acquires a GSV or SSV only after payment of at least first 2 consecutive policy years’ premiums.

Other Important Aspects you must know: Death Benefit: Where Sum Assured on Death is defined as higher of :

A) Sum Assured

B) 105% of Total Premiums Paid as on date of death

Where, Sum Assured is defined as 11 times or 7 times of the Annualized, Premium; will be applicable as per selected multiple at inception.

Survival and Maturity Benefit:

1. Short Term Income & Long Term Income: Provided the policy is in-force, ‘Assured Income Instalment’ plus ‘Loyalty Income Instalment’ will be payable to

You at the end of every month/quarter/half year/year as per the chosen Income Frequency. The same shall be paid post completion of Premium Payment Term. Deferment Period till the end of Policy Term. At the end of the Policy Term you will get ‘Final Benefit’ equal to 100% of Total Premiums Payable on Maturity.

If ‘Step-up Income Option’ benefit has been opted: Provided the policy is in-force, An additional step up income calculated as 5% of the First year Annual. Assured Income will be added every year on each Income Anniversary payable from the start of the Income Pay-out Period. This benefit shall be payable to You till the end of the Income Pay-out period.

2. Early Income: Provided the policy is in-force, During PPT- Provided the policy is in-force, “Immediate Income Instalment” is payable to You at the end of every month/quarter/half year/year as per the chosen Income Frequency. The same shall be paid from 2nd year onwards till the end of Premium Payment Term. Post PPT- Provided the policy is in-force, ‘Assured Income Instalment’ plus ‘Loyalty Income Instalment’ payable to You at the end of every month/quarter/half year/year as per the chosen Income Frequency. The same shall be paid post completion of Premium Payment Term till the end of Policy Term.

At the end of the Policy Term you will get ‘Final Benefit’ equal to 100% of Total Premiums Payable on Maturity.

Premiums paid and benefits receivable in this plan may be eligible for tax benefits. Tax benefits are subject to change in tax laws. Please consult your tax advisor for details.

Applicable taxes including Good and Service tax, as per government regulations, will be levied additionally and are to be borne by the Policyholder.

Comment on Canara HSBC Guaranteed Plan Gain Review below