The internet giant Google has entered the already crowded Indian digital payment space with their new UPI based Application “Google Pay” for Android and iOS. Unified Payment Interface (UPI) is the NPCI initiative launched previous year with the support of all the banks in India (Schedule II banks). This is the fastest way of digital transaction which is gaining popularity on daily basis. Google Pay is simply a different payment interface than other wallets and other UPI enabled payment interface like PayTm, Freecharge, SBI Pay, ICICI Pockets, Syndicate Bank Mobile banking etc.

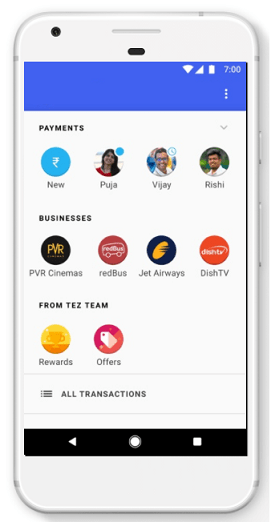

Google Pay for Business is having a very clean interface with lot of unique features which are currently not provided by any of the wallets or UPI enabled banking platform or mobile banking application of any of the banks. Whether that is SBI Pay, Union Pay, ICICI Pockets or any other interface.

Read : How To Scan & Pay Using Syndicate Bank Bharat QR Mobile Application ?

What is Google Pay for Business ?

Google Pay application for businesses and merchants is entirely the customized interface through which any of the customer with current or business account can link. Currently Merchants with individual current accounts can receive up to ₹50,000 per month with UPI with no fees. Based on various banks, charges will be levied to the transaction above Rs 50,000. Currently there is no MDR type of concept (i.e. Merchant Discount Rate). There is simplest KYC documentation for transaction up to Rs 50,000 per month.

Read : How To Install UPI on Mobiles ?

How Does Google Pay is Different for Merchant ?

Merchant with Google Pay application can get their own customized channel through which the businesses can be engaged directly with their customers with various activities like Sharing offers directly to their mobile inbox, share offers, send payment reminders, mobile links for their business website, customer support, and more.

Google Pay integration for Online Payment Acceptance

Google Pay also provide “Payment Request API” which can be integrate on their website and merchant can accept payment securely via UPI . This is very useful in case of certain merchants which are having online business to run.

Read : How To Use BHIM Apps for Fund Transfer ?

Mode of Payments

Google Pay is having various mode of receive and sending money. Option are :

- The app’s “Cash Mode” works quite like the NFC feature and lets the user send or receive payments to anyone nearby without sharing details such as their bank account number or mobile number.

- The app makes use of QR scan and lets the user make or receive payments scanning the QR code.

- UPI enabled payment interface linking the bank account.

The Google Pay for business is wonderful initiative and google branding will naturally push better technology and interface. Currently Google Pay is supporting all the enabled banks on UPI for payment. Google Pay is naturally the competitor of government sponsored “BHIM” application.