Steps to Apply Canara Robeco Mid Cap Fund NFO through Canara Bank Online, Mobile Banking or visiting the branch. Canara Robeco is launching a NFO (New Fund Offer) ‘Canara Robeco Mid Cap Fund’ – an open ended equity scheme with an objective to generate capital appreciation by investing predominantly in equity and equity related instruments of mid cap companies.

The salient features of Canara Robeco Mid Cap Fund are:

Key Highlights :

This scheme invests in following type of instruments:

Equity and Equity related instruments of Midcap companies (65-100%),

Equity and Equity related instruments of companies other than Midcap (0-35%),

Debt and Money Market Instruments (0-35%),

Units issued by REITs and InvITs (0-10%).

This scheme has growth and income distribution cum capital withdrawal options.

The Minimum amount of investment:

Rs.5000/- (Rupees Five Thousand Only) for Bulk.

Rs. 1000/- (Rupees One Thousand Only) for SIP.

Also Know – Open Canara Bank NPS Account through Digi Locker, How to Guide ?

How To Apply Canara Robeco Mid Cap Fund NFO ?

Follow the below steps to apply Canara Robeco Mid Cap Fund NFO through Internet Banking or Mobile Banking or after visiting the branch.

- Visit the Nearest branch of the Canara Bank

- Fill the form along with Cheque of the investment account

- Collect an acknowledgement for the same.

- Amount will be debited by EOD or next day.

- Thant’s done ! You will receive the details about the registration of NFO through SMS and Email from the Canara Robeco Mutual Fund.

Frequently Asked Questions (FAQs)

1. What is the Minimum amount for the investment in NFO ?

Answer : Minimum amount is Rs 1000/- for SIP and Rs 5000 as one time.

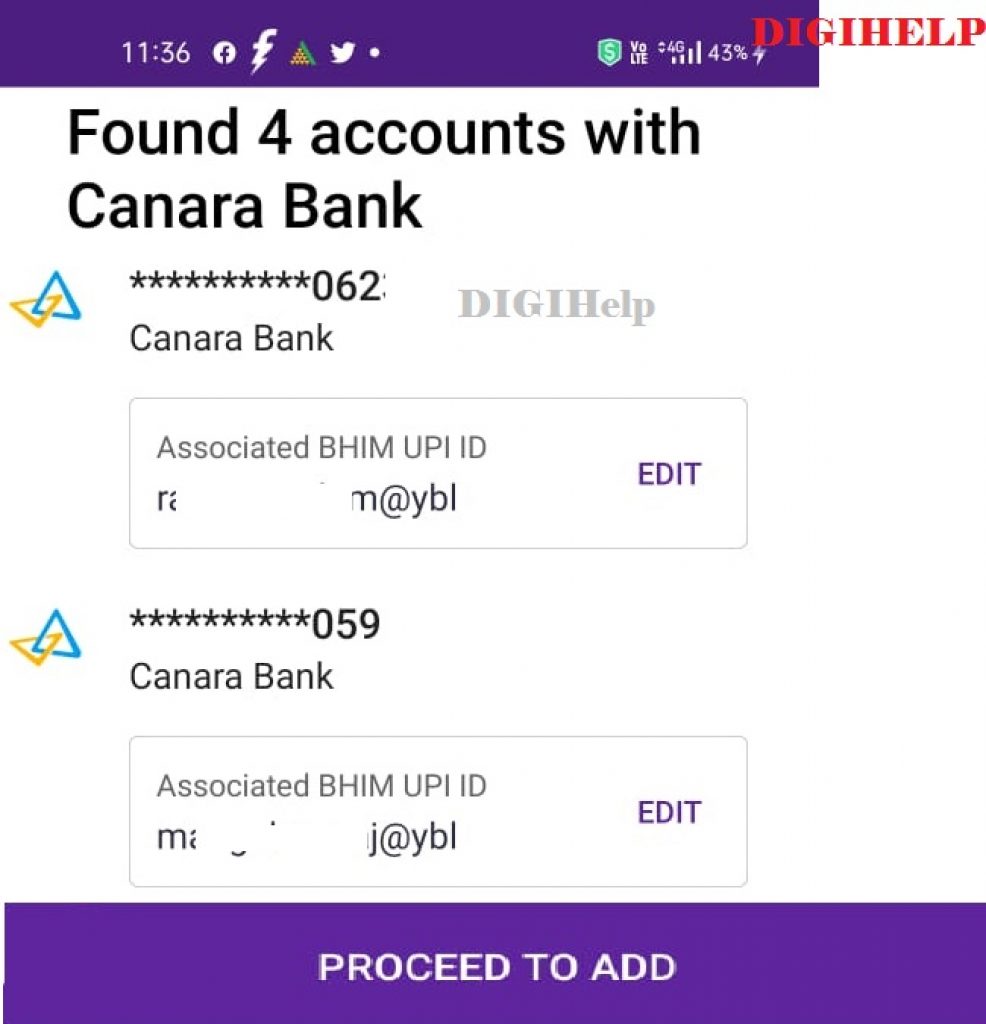

2. Can I apply through Canara Bank ai1 Mobile Application ?

Answer : Yes, you can login to Canara Bank Mobile Banking and apply.

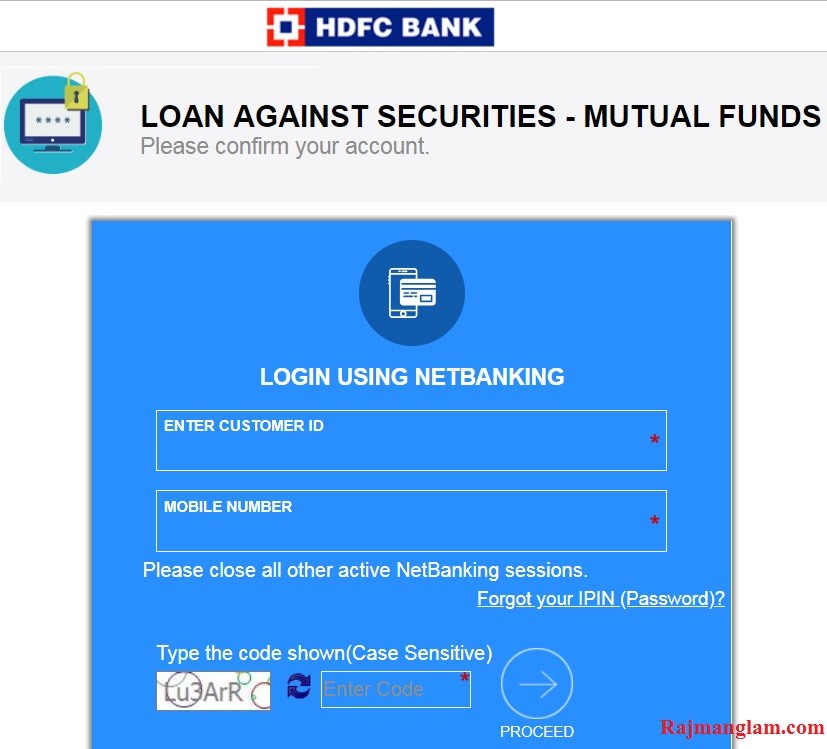

3. I don’t have account in Canara Bank, Can I still invest in it ?

Answer : Yes, but advisable to open an account with the bank for easy transactions.

NOTE: SUBSCRIBE WITH YOUR EMAIL ID FOR UPDATES ON ALL NFO