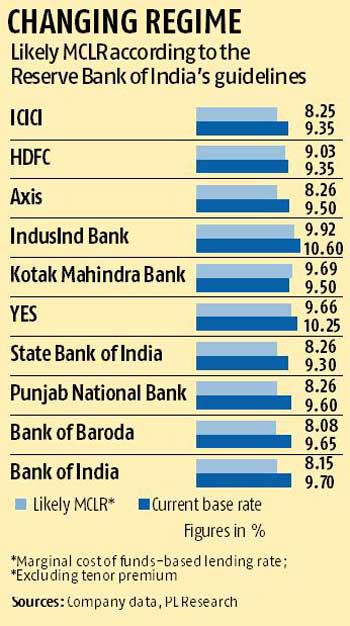

How To Register Rupay Card For Online Transaction, Mobile Recharge ? – Rupay card are issued by almost all the banks in India and available for registration for online transaction i.e. BOB (Bank of Baroda), HDFC, SBI, SBH, Syndicate bank, Bank of India (BOI), Punjab National Bank(PNB), ICICI bank, Axis Bank, Canara Bank etc. Rupay Card is the Indian reply to VISA and Mastercard.

Rupay card is the brand of National Payments Corporation of India (NPCI). As like any other Debit card/Credit Card with VISA or MasterCard or Diner’s card or American Express Card, the Rupay card can be used for making transaction through any mode whether Online Transaction or for withdrawing money at ATM card except foreign transaction. Rupay card are payable in India and can be used for such transaction which are settle in India only. Hence the foreign transaction cannot be done through Rupay Card currently.

[highlight]Read : How To Register Debit/Credit Cards for Online Transaction By VISA/MasterCard ?[/highlight]

Rupay card gained the popularity after launch of Jan Dhan Scheme for opening basic account where it was mandatory to give Rupay Debit Card to account holders. Kisan Credit Card (KCC) holders are also provided with Rupay Debit cum ATM card.

[highlight]Read : Jan Dhan Yojana – Key Features[/highlight]

Rupay Debit Card Benefits

NPCI Rupay card is the Make in India initiative hence the transaction and settlement cost are very less compare to VISA and MasterCard. For RuPay Card, there will be no one time joining fee with transaction charges are much lower than the existing VISA and MasterCard enabled debit cum ATM card for any transaction.

As like any other brand card , RuPay card can also be used at all ATMs and most of the merchant establishments and online payments as well.

[highlight]Read : How To Pay SBI Credit Card Bill By NEFT ?[/highlight]

How To Enable Rupay Card Registration of Various Banks ?

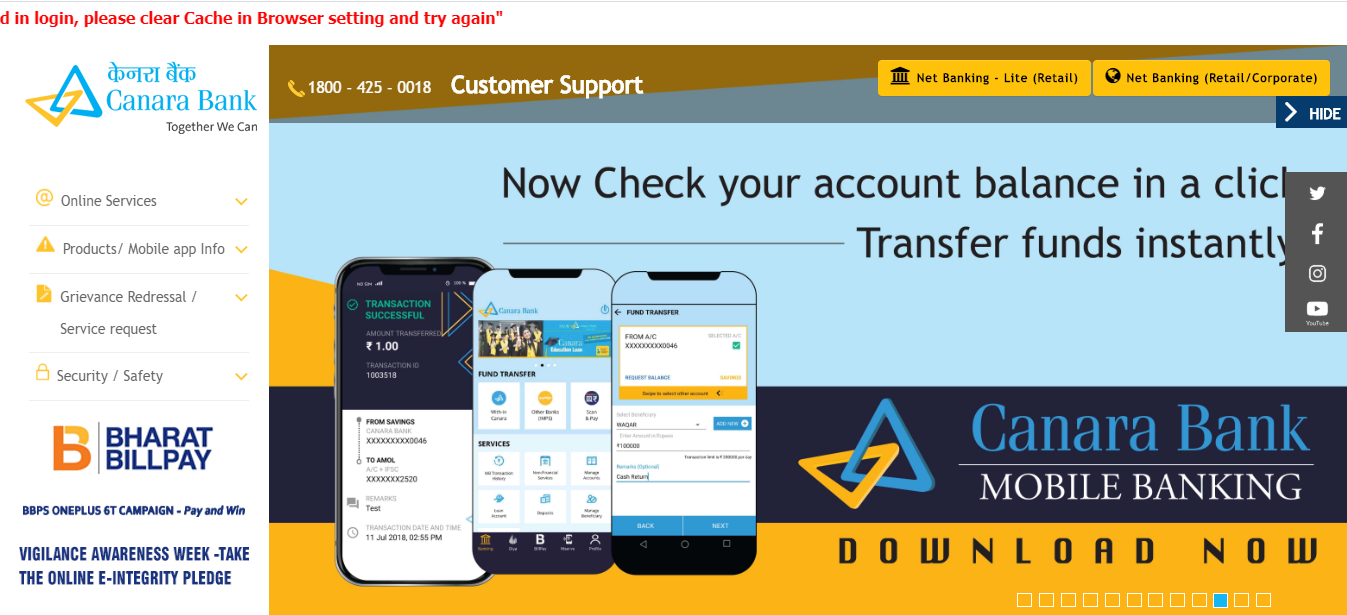

Rupay Card are used for Online Shopping and any other transaction. Holder of Rupay Debit Card find problem in making payment online due to non registration of their Rupay card. The customer of any bank operating in India like SBI,Andhra bank,Corporation bank,Private and Public Sector Banks may follow the below guidelines to register their rupay card for online transaction.

- Rupay Card online registeration have been made mandatory by NPCI for any E-commerce services. Registration can be done during your first transaction or on your bank’s website.

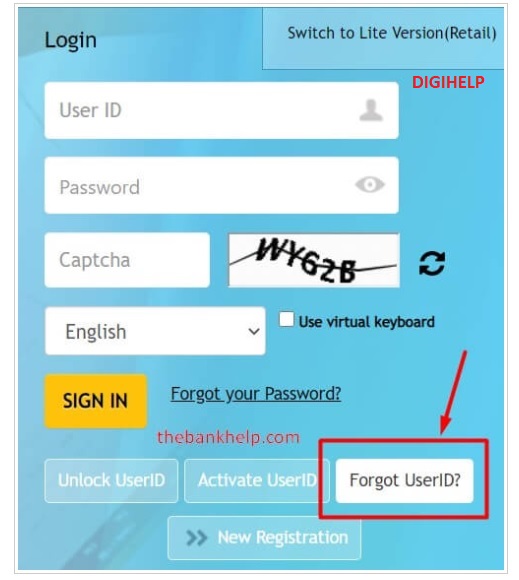

- Visit Your Bank’s Website for Rupay Card Registration Page

- Enter Your Card number , Expiry date and CVD2 number of the Rupay Card

- An OTP (One Time Password) will be sent to the Registered mobile number and email id of the customer registered with bank account.

- Provide OTP received on your mobile number.

- Choose the transaction image which will be the trust authentication of the payment in online mode. This image will appear in any online transaction to validate the true transaction. This is important to save customer from fake or phishing.

- Provide Your ATM Pin and Generate your verified by Rupay Card transaction password.

- Each and every bank has little different mode for generating the password for Online payment.

Frequently Asked Questions (FAQ)

- How do I register for RuPay E-commerce service?

- Registration for RuPay E-commerce (PaySecure) can be done during your first online transaction or on your bank’s website.

- Do I need to have a separate RuPay PaySecure PIN?

- No, you will be required to enter your existing ATM PIN during the transaction.

- What if the backdrop of the PIN Pad is not a look alike of my RuPay Debit Card?

- The customer must terminate the transaction immediately and contact the bank to notify the issue.

- What if I forget my image password?

- There is an option to re-register on the screen that will help customer to register the card again and choose a new image.

- What if the phrase displayed is wrong?

- The customer must terminate the transaction immediately and contact the bank customer care to notify this issue. The phrase is displayed as an anti-phishing measure to prevent fraud.

- What happens if I forget my ATM PIN?

- Please contact the bank to request a new ATM PIN.

- What is CVD (Card Validation Data)?

- It’s a three digit number printed on the back of the card.

- What to do if my phone number is not registered with the bank?

- Please get in touch with your bank for registering your mobile number. Do not forget to update the same every time you change your number.

- How long is the OTP valid?

- It varies from issuing bank to issuing bank.

- Will this OTP be valid while re-trying the transaction?

- No, the OTP is valid only for single transaction.

- Can phrase include special characters and number?

- Yes, phrase can include special characters and numbers. Length of phrase should not exceed 40 characters.

- Why is phrase required?

- This unique feature plays a vital role in establishing authenticity of the web page. For subsequent transactions, the customer has to acknowledge this phrase. This is an anti-phishing feature.

- What to do if my card gets blocked on exceeding the number of attempts to select the registered image?

- The customer needs to re-register while making a new online transaction.

- Will I be able to use my card on ATM and POS after being blocked for online transactions?

- Yes.

![[Fixed]- Union Bank of India, UBI Internet Banking Not Working](https://www.rajmanglam.com/wp-content/uploads/2021/01/Union-Bank-of-India-Internet-Banking.jpg)

![[Resolved] – SBI Error No Accounts Mapped for This Username](https://www.rajmanglam.com/wp-content/uploads/2020/09/SBI-No-Accounts-Available-for-the-User-1.jpg)